Feeling frustrated after a loan application was denied? You’re not imagining it. If you’re wondering why is it hard to get a personal loan right now, you are facing a real and growing trend. Traditional banks are tightening their belts in 2025, making it tougher for everyone.

It’s not just you. Economic shifts mean banks are becoming far more “selective” about who they lend to, examining their own “portfolio quality” and reducing risk. This shift away from traditional lending can leave many qualified borrowers feeling stuck. As a financial education platform, ClearCreditLoan is here to explain why this is happening and, more importantly, to provide a clear strategy to improve your chances.

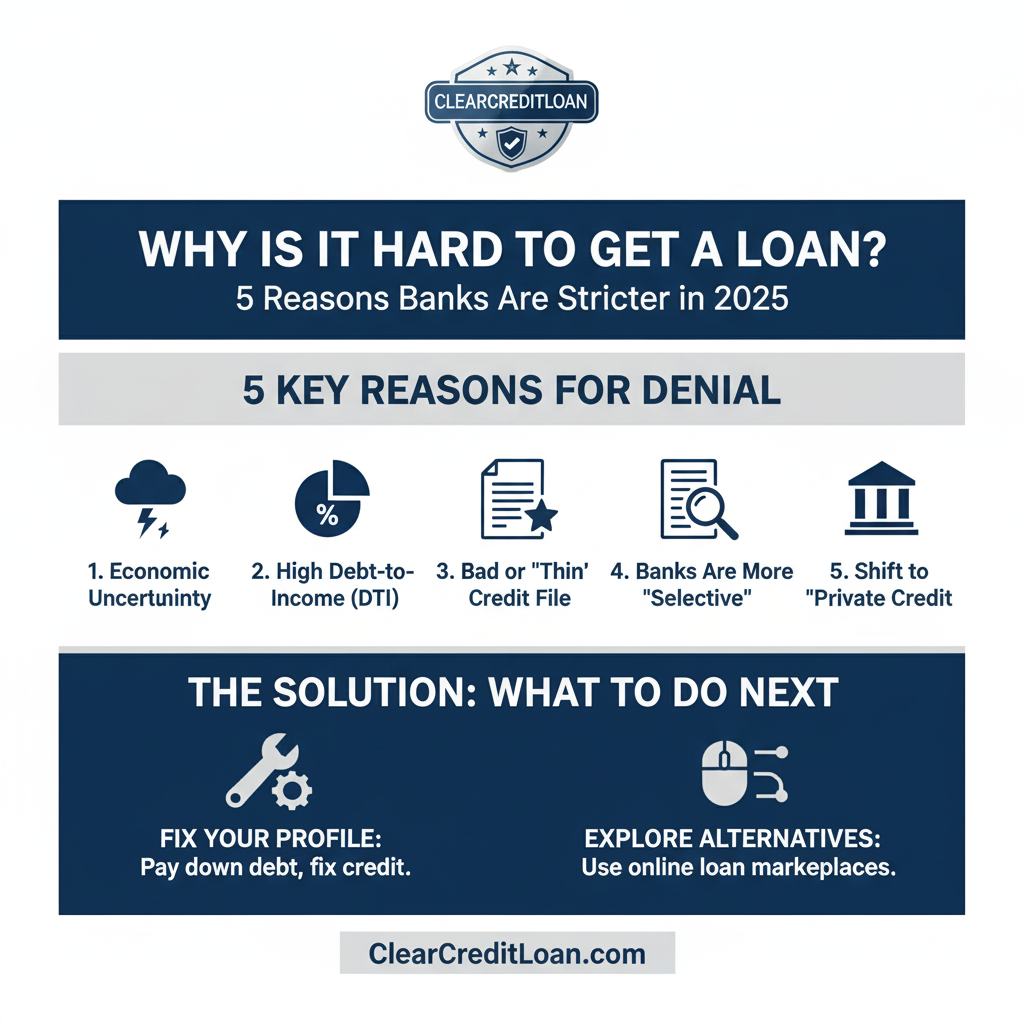

5 Key Reasons Why Is It Hard to Get a Personal Loan Right Now

If you’ve been rejected, it’s likely due to a combination of these macro (big picture) and micro (your personal profile) factors.

1. Economic Uncertainty & Inflation

This is the biggest macro reason. When inflation is high and the economy is uncertain, banks get nervous. They become “risk-averse.” They tighten their lending standards to protect their “portfolio quality,” meaning they only want to lend to the safest applicants (those with high credit scores and high income). This economic analysis from sources like Forbes shows that lenders are preparing for a potential slowdown.

2. Your Debt-to-Income (DTI) Ratio is Too High

This is the #1 personal reason for denial. Your DTI is how much of your monthly income goes toward debt payments. If your rent, car note, and credit card payments already eat up 40-50% of your income, lenders see you as a high risk. The CFPB (Consumer Financial Protection Bureau) explains that lenders use DTI to measure your ability to repay.

3. You Have Bad Credit (or Thin Credit)

This is the most obvious hurdle. If you have bad credit (a FICO score below 630), you represent a high risk of default. This is the painful reality of our complete guide to living with bad credit. Even if you’re not “bad,” a “thin file” (not enough credit history, common for students) also makes banks nervous.

4. You Asked for Too Much (or Too Little)

This sounds strange, but lenders have “sweet spots.” Many traditional banks don’t want to bother with small loans ($1,000 – $2,000) because they don’t make enough profit. Conversely, if you ask for $50,000 but your income only supports $20,000, you’ll be denied.

5. The Rise of “Private Credit” (A B2B Trend)

This is a trend happening behind the scenes. Many banks are shifting their focus to “private credit” (lending to other companies) rather than individuals. This means there is simply less appetite for personal loans in general, making the entire market more competitive.

The Solution: What to Do If Banks Say “No”

So, if you’re wondering why is it hard to get a personal loan from a bank, what’s the solution? Don’t give up. Your strategy just needs to change.

1. Improve Your Profile (The Long-Term Fix)

- Lower Your DTI: The best way is to pay down existing debt, especially credit cards. If you’re trapped in high-interest debt, our 5-step guide to debt consolidation might be your best path forward.

- Fix Your Credit: Pay every bill on time. If you have bad credit, consider a secured credit card to start rebuilding positive history.

2. Explore Alternatives (The Immediate Fix)

Since traditional banks are stricter, your best bet is to look at online loan marketplaces.

- Why? These platforms are not lenders themselves. They are “matchmakers” that connect your single application to a network of dozens of different lenders, including those who specialize in bad credit, thin files, or specific income types.

- The Benefit: You get to compare multiple offers (using a “soft pull” that doesn’t hurt your score) from lenders who are actively looking to lend to people exactly like you.

It’s true: banks are making it harder to get a personal loan. But that doesn’t mean you’re out of options. The solution is to stop relying on traditional banks and start comparing online lenders who are built for the modern borrower.

ClearCreditLoan can help. Use our free, secure tool to compare pre-vetted loan partners that specialize in options for various credit situations. See your potential offers without impacting your credit score.