Understanding what should students borrow money for is one of the most critical financial lessons in college. Taking out loans can be a powerful tool to invest in your future, but borrowing for the wrong reasons can lead to a decade or more of crushing debt and regret.

As a student, you’ll encounter two main loan types: federal student loans (for school costs) and personal loans (for almost anything else). Knowing when it’s smart to use debt versus when you absolutely shouldn’t is key. As a financial education platform, ClearCreditLoan is here to provide unbiased guidance. We don’t lend money, but we help you think critically about borrowing decisions. This guide breaks down the smart reasons versus the costly mistakes to help you avoid costly financial regrets down the road.

5 Smart Reasons: What Should Students Borrow Money For?

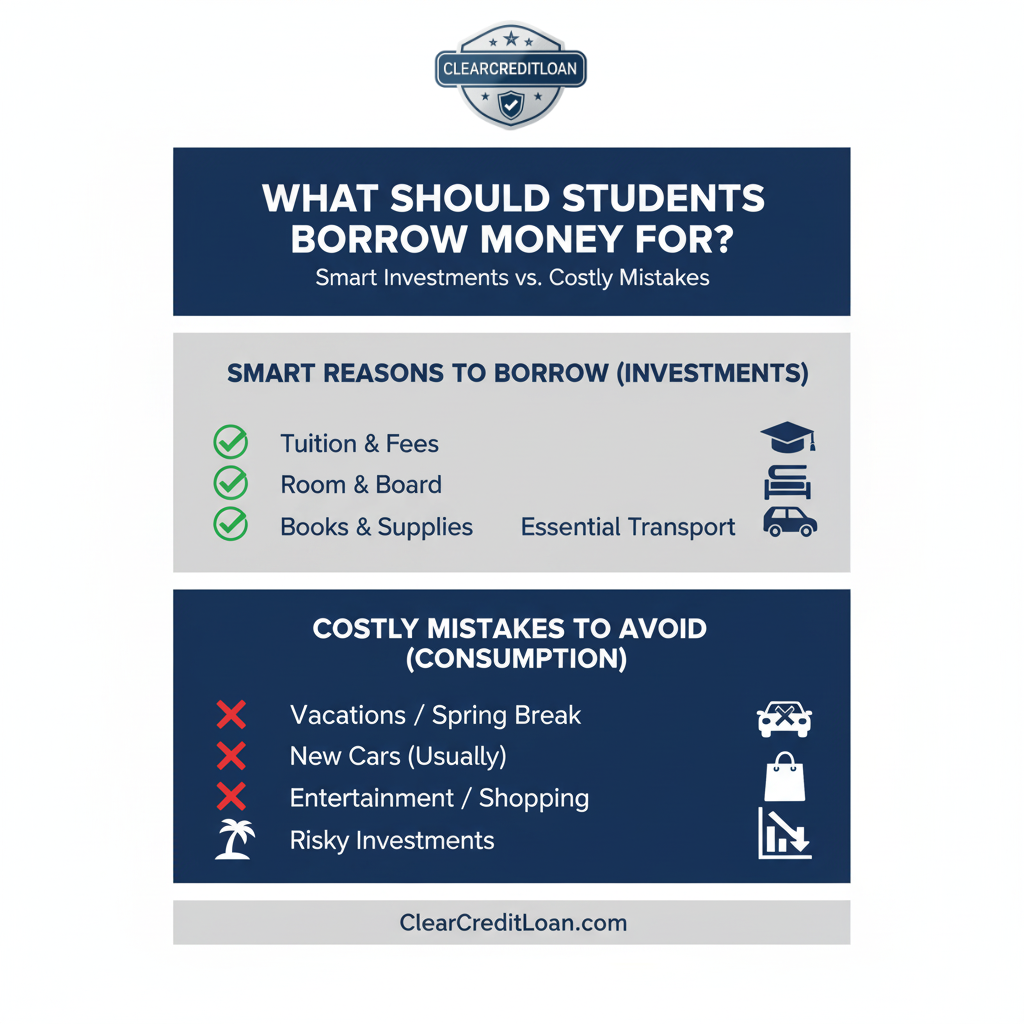

Borrowing money is smart when it’s an investment that will likely increase your future earning potential or well-being. Here are acceptable uses:

1. Tuition & Mandatory Fees

This is the primary purpose of student loans. Your education is arguably the best investment you’ll ever make. Using federal or private loans to cover these direct school costs is almost always a necessary and wise decision. Understanding the difference between Federal vs. Private loans is key here.

2. Room & Board (Housing & Food)

Whether you live in a dorm or off-campus, using loan funds for essential housing and a reasonable food budget is considered a legitimate educational expense. The official StudentAid.gov website outlines acceptable uses for federal loan funds.

3. Textbooks & Essential Supplies

Books, software required for classes, lab equipment, or a reliable computer needed for coursework are all valid educational expenses.

4. Transportation Costs (Essential Only)

This includes reasonable costs for commuting to campus (gas, public transport). It does not typically mean buying a car (more on that later).

5. Dependent Care Expenses

If you have children or other dependents, costs associated with their care while you attend school can sometimes be factored into your cost of attendance and covered by loans.

5 Costly Mistakes: What Students Should NEVER Borrow Money For

Borrowing for consumption (things that don’t increase your future value) is where students get into trouble. Avoid these:

1. Vacations & Spring Break

Putting a spring break trip on a loan or credit card might seem fun now, but you’ll be paying for that week on the beach (with interest) long after the tan fades. The Consumer Financial Protection Bureau (CFPB) strongly advises against borrowing for vacations.

2. A New Car (Usually)

Unless reliable transportation is absolutely essential for commuting to a mandatory internship or job, and you have exhausted all other options (used car, public transport), borrowing thousands for a new car is a major financial burden for a student budget.

3. Entertainment, Eating Out, Shopping Sprees

Using loan refunds for nights out, fancy dinners, new clothes, or the latest gadgets is a recipe for unnecessary debt. These are “wants,” not “needs,” and should be funded through savings or part-time work.

4. Risky Investments (Crypto, Stocks)

Never, ever borrow money (especially high-interest personal loans) to invest in volatile markets like cryptocurrency or individual stocks. This is gambling with borrowed funds, and the potential downside is catastrophic.

5. Covering Short-Term Cash Flow Gaps (If Payday Loans are Considered)

If you’re so short on cash that you’re considering a payday loan, borrowing more isn’t the answer. Focus on budgeting, emergency funds, or safer payday alternatives like credit union PALs. Understanding what should students borrow money for helps avoid these predatory traps.

The Bottom Line on What Should Students Borrow Money For

The golden rule is: Borrow only what you absolutely need, and prioritize borrowing for things that invest in your future. Federal student loans should always be your first choice for school-related costs. For other essential needs, compare reputable personal loan options carefully. Understanding what should students borrow money for is the first step toward responsible financial habits.

Making smart borrowing decisions now can set you up for financial success after graduation. If you need to explore loan options beyond federal aid, make sure you compare trusted lenders.

ClearCreditLoan helps you compare reputable personal loan partners for various needs. Check your options for free without impacting your credit score.