If you have bad credit, you’ve heard the advice: “You need to rebuild your credit.” But how, exactly? When no one will approve you for a loan or a regular credit card, how do you prove you’re responsible? The answer for millions of people is the single most powerful tool for this job: learning what is a secured credit card.

A secured credit card is not a magic wand, but it is the safest and most effective starting point for anyone with a low credit score or no credit history at all. As a financial education platform, ClearCreditLoan is here to demystify this tool. We’ll explain exactly what is a secured credit card, how it’s different from a debit card, and how you can use it as a strategy to take back control.

What Is a Secured Credit Card (And How Is It Different)?

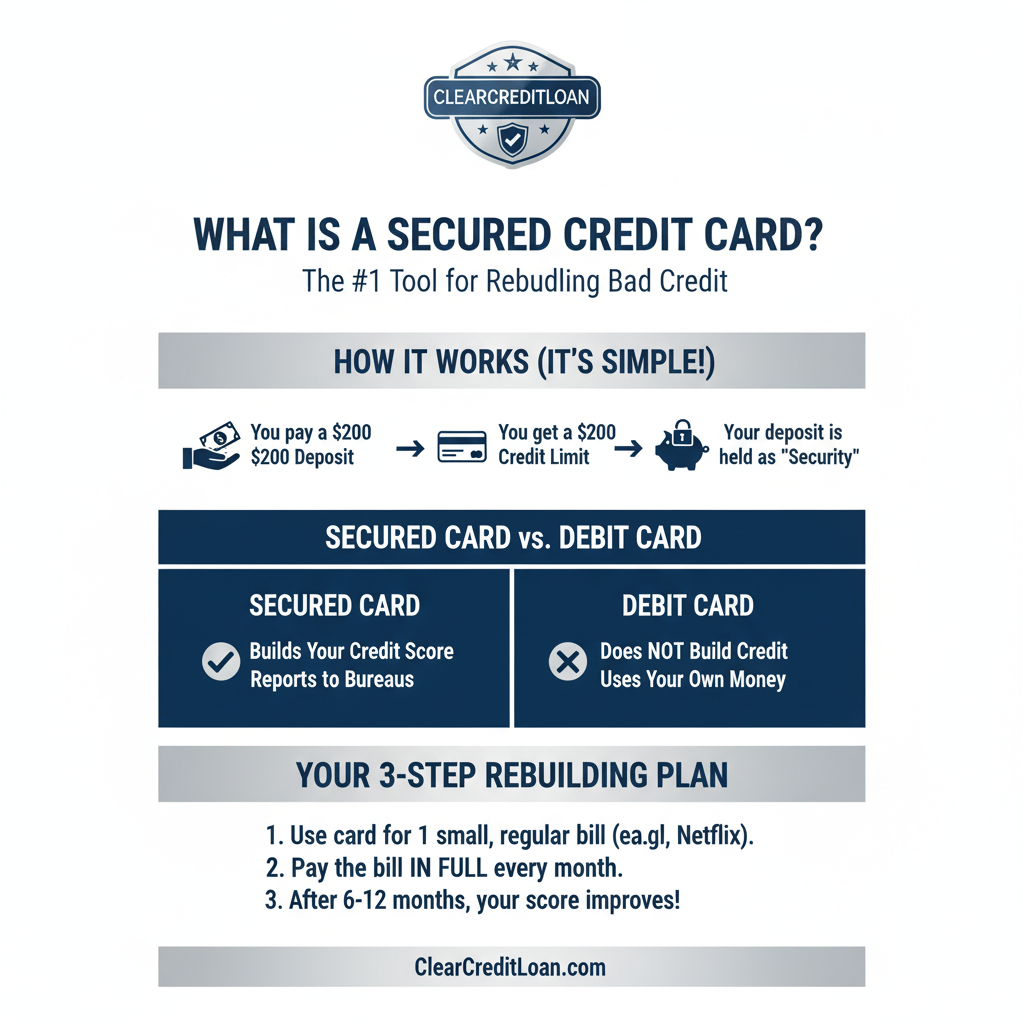

A secured credit card is a real, fully-functional credit card that is “secured” by a refundable cash deposit you pay upfront.

This deposit is your “collateral.” It’s your way of telling the bank, “I am serious about this. If I fail to pay my bill, you can keep my deposit.” This removes all risk for the bank, which is why they are willing to approve applicants with bad credit.

- The Deposit IS Your Credit Limit: If you deposit $200, your credit limit will be $200.

- It is NOT a Debit Card: This is the key. You still have to pay your bill every month. The deposit just sits there as insurance.

Secured Card vs. Unsecured Card

- Secured Card: Requires a cash deposit. Designed for building/rebuilding credit.

- Unsecured Card: The classic credit card. Requires no deposit. Based 100% on your creditworthiness. This is what you “graduate” to.

Secured Card vs. Debit Card

- Debit Card: Uses your own money from your checking account. It does NOT build credit.

- Secured Card: Uses the bank’s money (your credit line), which you pay back. It DOES build credit because the bank reports your payments to the credit bureaus.

How Does a Secured Credit Card Rebuild Your Credit?

This is the most important part. A secured credit card is the best tool to fix what is a secured credit card‘s biggest problem: a bad payment history.

Your credit score is primarily based on your payment history (35% of your FICO score). Having bad credit means you have a history of missed payments. A secured card gives you the chance to create a new, positive payment history.

Here’s the process:

- You get a secured card.

- You make one small, recurring purchase (like a $10 Netflix bill) each month.

- You pay that $10 bill in full and on time every single month.

- The card issuer reports this positive, on-time payment to all three credit bureaus (Equifax, Experian, TransUnion).

- After 6-12 months of perfect payments, your credit score starts to rise, proving you are now a low-risk borrower.

This is the exact opposite of the pain points of living with bad credit ; it’s the first step to reversing the damage.

How to Choose the Best Secured Credit Card for Bad Credit

Not all secured cards are equal. When you’re ready to apply, look for these features:

- Reports to All 3 Credit Bureaus: This is non-negotiable. If it doesn’t report, it’s useless for building credit. (All major issuers do).

- Low (or No) Annual Fee: Many great secured cards have a $0 annual fee. Avoid cards that charge $49 or more per year if possible.

- Clear Graduation Path: Look for a card that “graduates.” This means after 8-12 months of responsible use, the bank will automatically review your account, refund your deposit, and convert you to a regular unsecured credit card.

- Low Deposit Requirement: Many cards let you start with a deposit as low as $200.

The CFPB (Consumer Financial Protection Bureau) offers a great checklist for comparing secured card offers.

Understanding what is a secured credit card is the first step. The next step is choosing the right one for your journey.

These cards are the #1 tool for rebuilding your financial future. Once you’re ready to start, comparing the top offers is the best way to avoid high fees and find a card that will graduate with you.

Read our review of the best secured credit cards to compare top-rated offers from issuers who specialize in helping people rebuild credit.**