Using debt for everyday spending isn’t just a headline—it’s daily reality for many households. In 2025, high revolving APRs, rising delinquencies, and the spread of BNPL at checkout changed how people buy groceries, fuel, and essentials. This guide explains the 10 real reasons behind the shift—and a practical rulebook for when it actually makes sense.

Using debt for everyday spending: the 2025 backdrop

Credit card APRs hover in the low-20% range on average, while delinquencies have climbed compared with the pre-pandemic period. BNPL has expanded from apparel to “everyday” categories, making short-term installment tabs common at major retailers. (Details in sources)

10 real reasons Americans are using debt for everyday spending

1) Price volatility and timing gaps. When paychecks don’t align with bill cycles or grocery sales, debt smooths timing—especially with autopay/instalments.

2) Inflation hangover on essentials. Even as headline inflation cools, categories like food or services remain sticky, pushing more families to revolve small balances.

3) Widespread checkout financing. BNPL buttons are now baked into carts for groceries and household items, normalizing micro-loans for everyday needs.

4) High but accessible revolving credit. Cards are ubiquitous; approvals can be easier than personal loans, so people swipe despite high APRs.

5) Retail card promos and IPs. Store cards and card “installment plans” promise convenience or discounts but can mask high fees or revert-to rates.

6) Income irregularity. Hourly shifts, gig work, tips, or delayed reimbursements make short-term credit a buffer when cash flow dips mid-month.

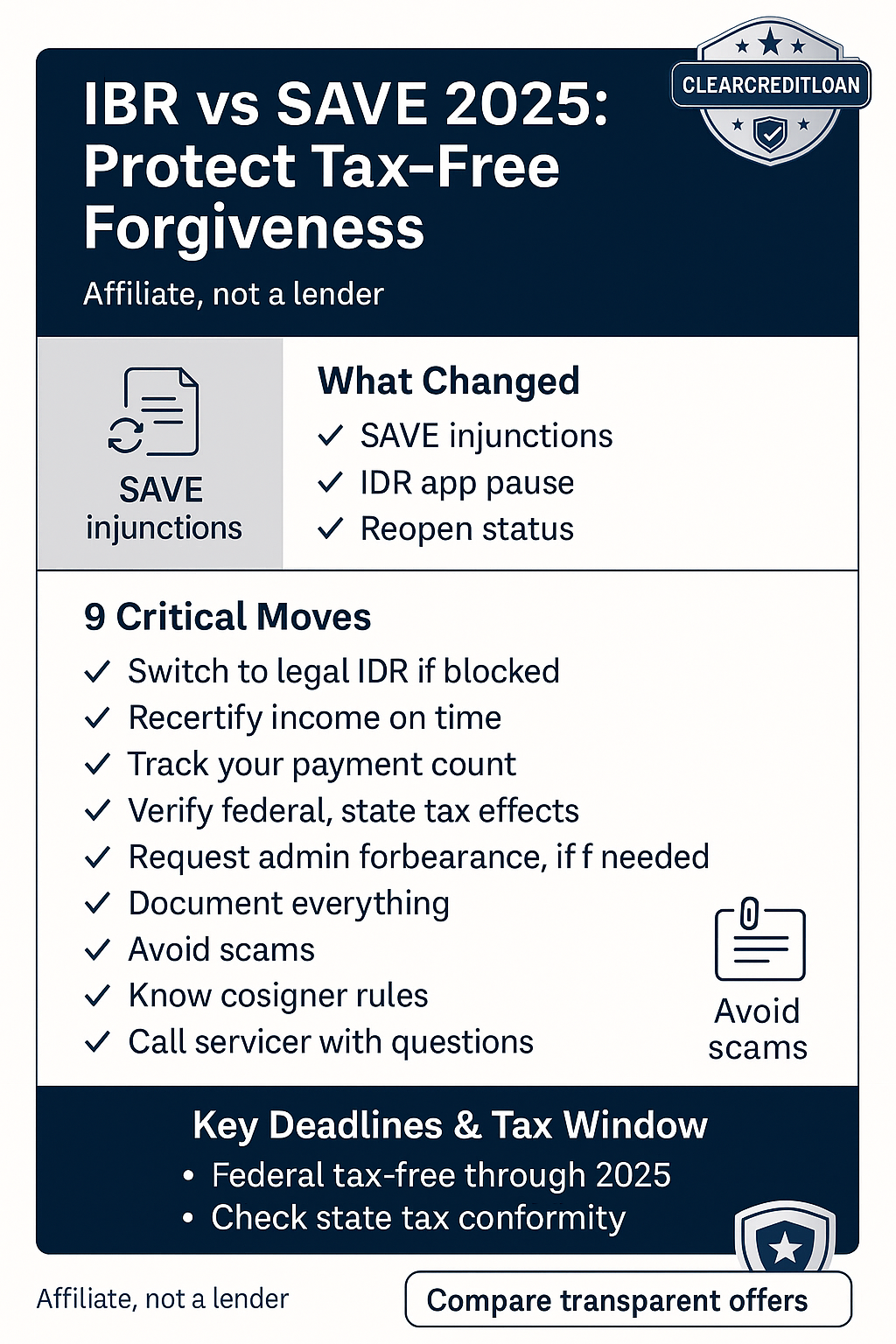

7) Student-loan resumption stress. Borrowers resuming payments re-prioritize cash, sometimes pushing essentials to cards/BNPL to avoid delinquency elsewhere.

8) Emergency micro-shocks. Co-pays, car repairs, or utility spikes push budgets off track; people lean on credit rather than miss rent.

9) Behavioral frictions. One-click checkout and split-pay defaults lower the “pain of paying,” so carts creep up unnoticed.

10) Marketing + social proof. “Four easy payments” and influencer norms make debt feel routine—even for staples.

When using debt for everyday spending actually makes sense

- Short duration, clear exit. You have a defined payoff date (e.g., next paycheck) and a plan to auto-clear the balance.

- Transparent cost. You know the APR/fees or the BNPL late-fee policy, and the total cost is negligible for the time used.

- Budget guardrails. You protect rent/food/transport/insurance first, then repay debt from surplus. For practical tactics that make this work, see How to Budget and Save Money.

- Fixed-rate alternative beats the status quo. If your blended card APR is ~20%+ and you need months—not days—to repay, a short fixed-rate installment may be safer than revolving balances.

When it doesn’t make sense (red flags)

- No payoff plan beyond “figure it out.” Revolving balances snowball at 20%+ APR.

- Stacking BNPL tabs across providers. Multiple micro-plans can collide with bill due dates.

- Retail card traps. Discounts up front, high rates and limited grace later.

- Minimum-payment treadmill. If you’re stuck paying interest only, pause spending and restructure.

Smarter playbook: cards, BNPL, and loans

Credit cards (revolving): Use for rewards only if you pay in full monthly. Otherwise, pick the shortest path to zero and avoid new swipes.

BNPL (installments): Reasonable for small carts repaid within 6–8 weeks with autopay; avoid stacking and late fees.

Personal loan (fixed-rate): Consider for multi-month needs or consolidation when the quoted APR + fees clearly undercut your blended card APR. Keep the term short and prepay when possible. For a refresher on how payments reduce principal vs interest, see How Amortization Works.

Five rules to keep everyday debt from becoming everyday stress

1) Set a weekly cap for essentials. Lock it in your notes app; stop at the cap.

2) Autopay + calendar nudges. Schedule repayments the day after payday or stipend.

3) One plan, not three. Choose one instrument (one BNPL plan or one short loan) and avoid stacking.

4) Track debt-free dates. Seeing the end date prevents drift.

5) Build a micro-buffer ($200–$500). Prevents “just one more swipe” when prices jump.

FAQ: using debt for everyday spending in 2025

Is BNPL really used for groceries now? Yes—usage has expanded to necessities as checkout financing spread.

Are interest rates still high? Average card APRs remain elevated; even brief revolving can be costly.

What if my income is irregular? Short instalments with autopay can work, but only if you budget for the full payoff and don’t stack.

Should I consolidate? If you carry balances month to month and can secure a lower fixed APR (with low fees) over a short term, consolidation can be safer than revolving—provided you stop new card spending.

For mindset shifts that reduce overspending, see Psychology of Debt: Reasons We Overspend.

We’re an affiliate, not a lender. Compare transparent options by APR, fees, and term. Use debt briefly and deliberately, automate repayments, and protect essentials first. If balances linger, consider a short fixed-rate plan that truly beats your blended APR—and lock in guardrails before you apply.