Finding safe student personal loans can be stressful. When you’re a student, needing extra cash for rent, a new laptop, or an emergency is a real-world problem, and “easy cash” lenders know this.

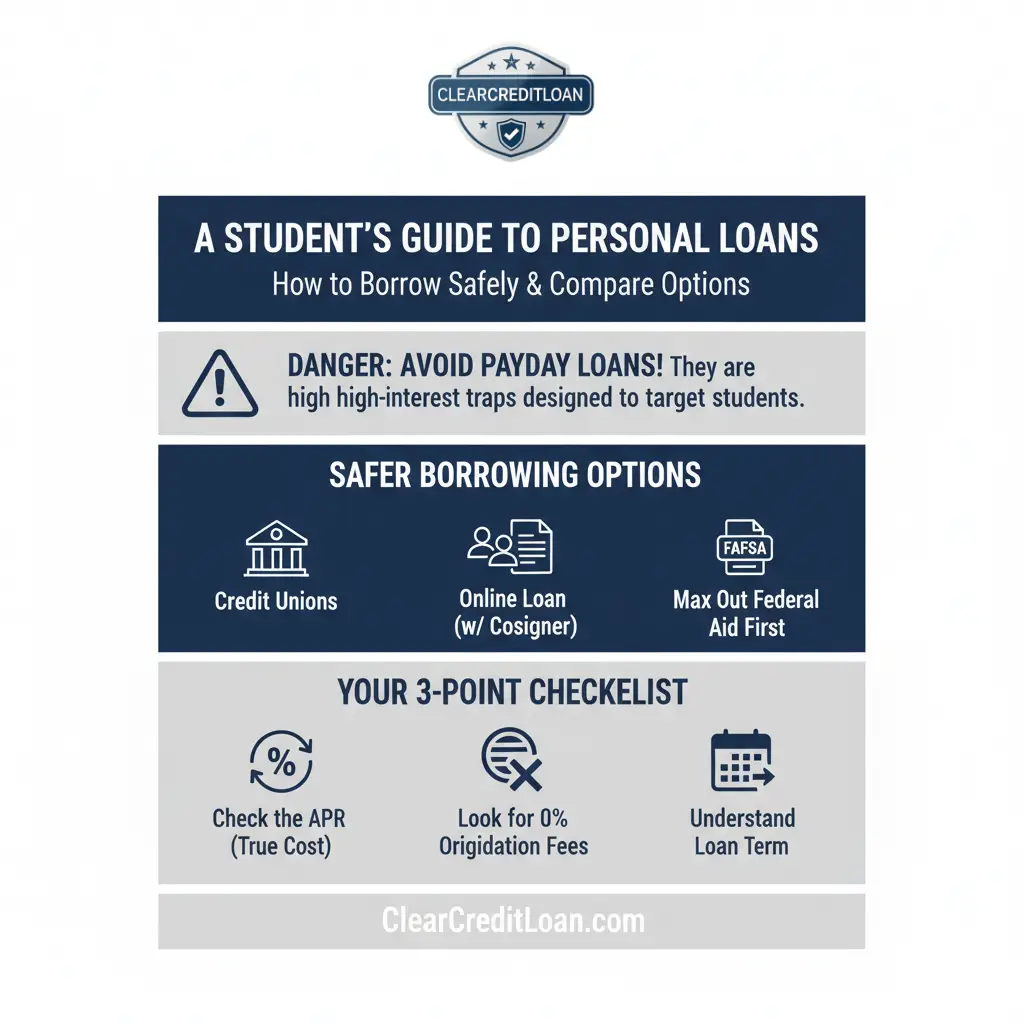

This is where students often get into trouble. They turn to high-interest “fast cash” or payday loans, digging a debt hole that’s hard to escape. But you have better, safer options.

As a financial education platform, ClearCreditLoan does not lend money. Our mission is to provide you with clear, unbiased information. This guide will explain the difference between personal loans for students and federal student loans, highlight safer alternatives, and show you how to compare your safest options.

Personal Loans vs. Federal Student Loans: What’s the Difference?

This is the most important thing you need to know.

- Federal Student Loans : These are (and should always be) your #1 choice. They are funded by the government, are used only for educational expenses, and have powerful borrower protections. You apply for these via the official FAFSA (Free Application for Federal Student Aid) website, run by the U.S. Department of Education.

- Personal Loans for Students : These are loans from private lenders (banks, credit unions, online lenders) that can be used for anything—car repairs, rent, a computer. They are credit-based, which is why most student personal loans require a cosigner.

The Danger: Why Students Are Targeted

Lenders offering “fast cash” or “no credit check” loans (like Payday Loans) specifically target students and low-income earners. They promise quick money but charge triple-digit interest rates (300-400% APR). They are a trap. We are committed to helping you find alternatives.

Safer Student Personal Loans: Your Best Options

If you have already maxed out your Federal Student Loans and still need funds, here are your safer choices, in order:

1. Credit Unions

If you or your parents are members of a credit union, start here. They are non-profit and known for offering smaller personal loans (sometimes called “Signature Loans”) with fair interest rates, even to members with limited credit.

2. A Reputable Online Lender (with a Cosigner)

This is the most common option. A cosigner (usually a parent or guardian with good credit) agrees to take responsibility for the student personal loan if you can’t pay. Their good credit allows you to “borrow” their credit history to get approved and, most importantly, to secure a low interest rate.

3. A 0% APR Credit Card (for Small, Short-Term Needs)

If you have fair credit (or can be an authorized user on a parent’s card) and the expense is small, a credit card with a 0% introductory APR offer can act as an interest-free loan IF you pay it off before the intro period ends. This is risky if you aren’t disciplined.

How to Compare Student Personal Loans (The Smart Way)

When you compare options, don’t just look at the monthly payment. Look at these three things:

- APR (Annual Percentage Rate): This is the true cost of the loan, including interest and fees. A lower APR is always better.

- Origination Fees: Does the lender charge a fee (e.g., 1-5% of the loan amount) just to give you the loan? Look for lenders with zero origination fees.

- Loan Term: How long do you have to pay it back? A shorter term (e.g., 2 years) means higher monthly payments but less interest paid. A longer term (e.g., 5 years) means lower payments but you’ll pay more in total interest.

Don’t navigate the lending world alone, and don’t fall for “easy cash” traps. Finding a trustworthy personal loan as a student is critical.

ClearCreditLoan helps you compare reputable, pre-vetted personal loan partners that work with students (often with cosigners) to find you a safe and affordable rate. Check your options for free.that work with students (often with cosigners) to find you a safe and affordable rate. Check your options for free.