Navigating the world of student loans can be overwhelming. For millions of students, these loans are the key that unlocks the door to higher education, but making the wrong choice can impact your finances for decades.

That’s why we created this comprehensive guide. We’re here to help you understand the student loans landscape before you borrow.

As a financial education platform, ClearCreditLoan doesn’t lend money. Our goal is to give you the clear, unbiased information you need to compare your options and choose the best path forward.

What Exactly Is a Student Loan?

A student loan is money you borrow to pay for educational expenses (like tuition, fees, books, and living costs) that must be paid back with interest. Unlike a scholarship or grant, a loan is not free money.

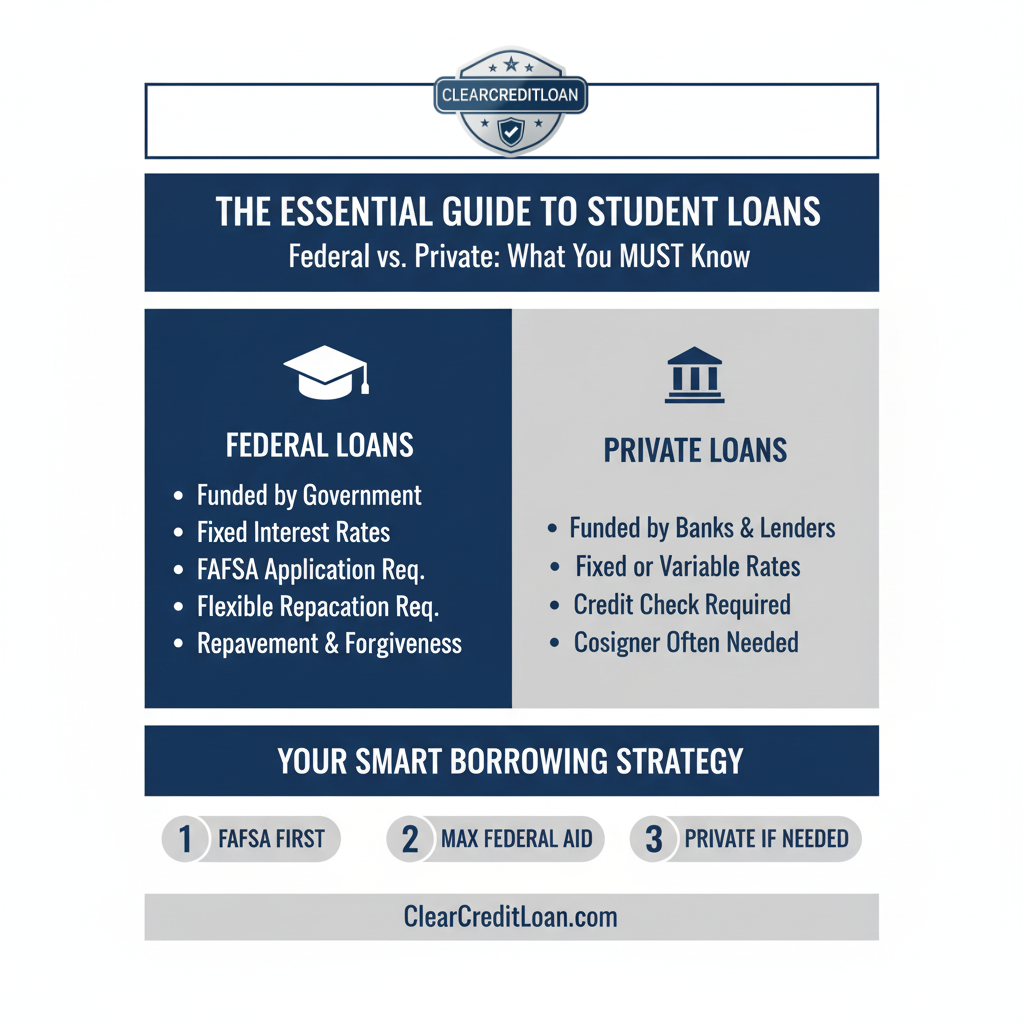

The entire student loan world is primarily split into two categories: Federal and Private. Understanding the difference is the most critical step you can take.

Federal Student Loans: The Starting Point

Federal student loans are funded by the U.S. Department of Education. This should always be your first option to explore.

To apply, you must complete the FAFSA (Free Application for Federal Student Aid), which you can find at the official government website: StudentAid.gov.

Key Benefits of Federal Loans:

- Fixed Interest Rates: The rate is set by Congress and stays the same for the life of the loan.

- Flexible Repayment: Offer options like income-driven repayment (IDR) plans.

- Forgiveness Programs: You may be eligible for loan forgiveness.

- No Credit Check (Mostly): Most federal loans for undergraduates do not require a credit check.

Types of Federal Loans:

- Direct Subsidized Loans: For undergraduates with financial need.

- Direct Unsubsidized Loans: For undergraduate and graduate students; financial need is not required.

- Direct PLUS Loans: For graduate students and parents.

Private Student Loans: Filling the Gap

Private student loans are offered by banks, credit unions, and online lenders (like many of the partners we review on ClearCreditLoan). These should be used to “fill the gap” after you have exhausted your federal student loan options.

Key Features of Private Loans:

- Credit-Based: Eligibility and interest rates are based on your (or your cosigner’s) credit history.

- Variable or Fixed Rates: You can often choose, but variable rates can change over time.

- Cosigner Often Required: Most students need a cosigner (like a parent) with good credit.

- Less Flexibility: They generally do not offer the same forgiveness programs or flexibility as federal loans.

Federal loans are the foundation, but finding the right private student loan to fill the gap is just as important. Ready to see what’s out there?

Compare personalized rates from our top-rated private student loan partners. It’s fast, free, and won’t hurt your credit score.