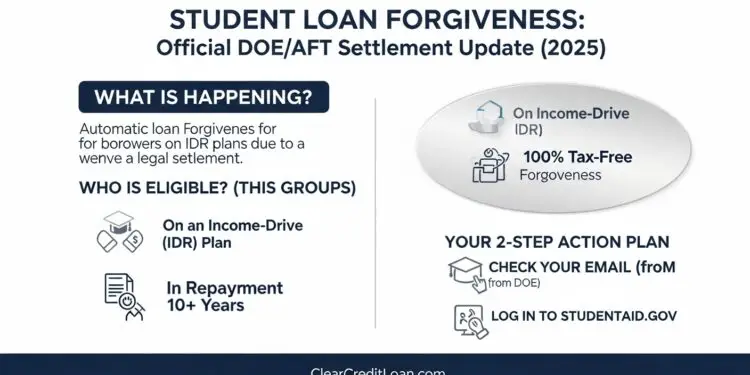

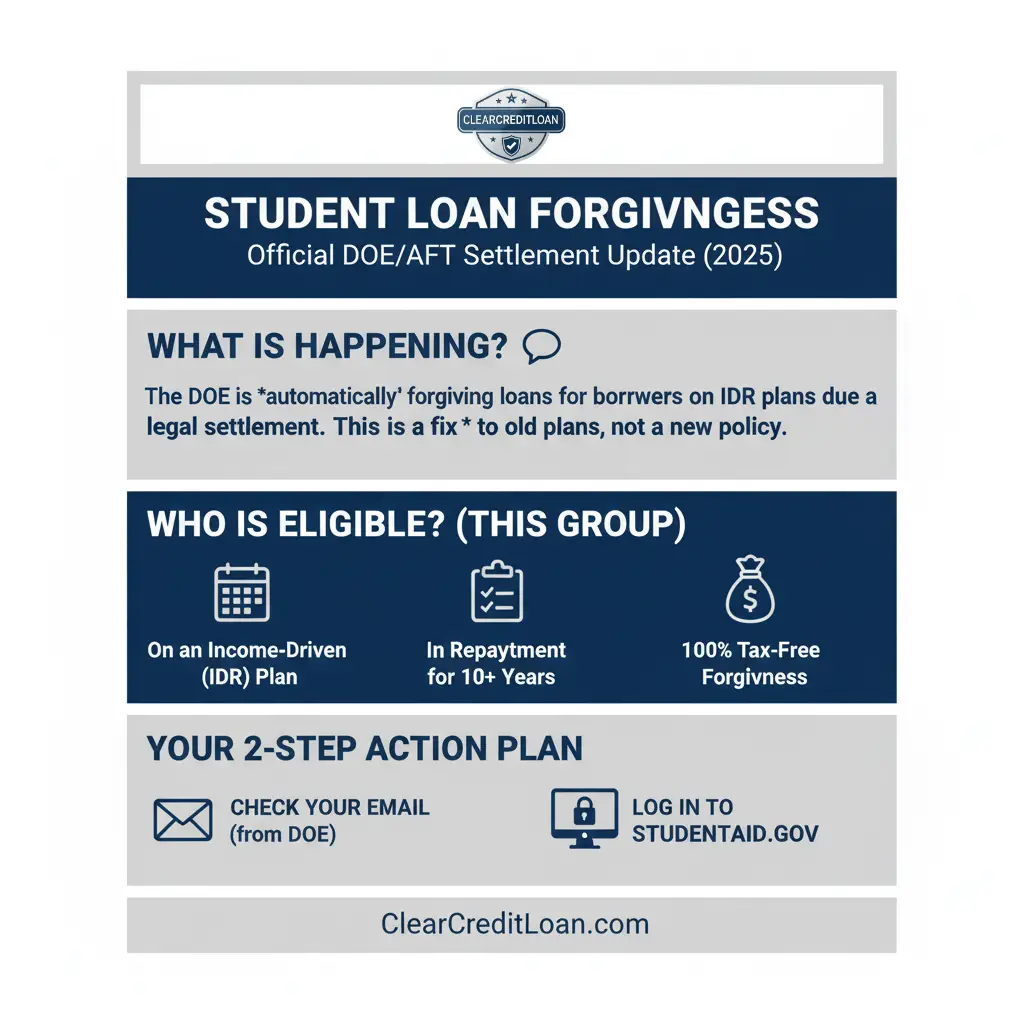

If you have federal student loans, check your email. The Department of Education (DOE) is currently sending notices for a new wave of student loan forgiveness. This isn’t a political promise; it’s the result of a legal settlement that is processing borrowers right now.

On October 17, the DOE, in partnership with the American Federation of Teachers (AFT), began notifying borrowers who are eligible for automatic debt cancellation under updated Income-Driven Repayment (IDR) plan rules. This action impacts an estimated 1.5 to 2.1 million borrowers.

As a financial education platform, ClearCreditLoan is here to cut through the confusion and provide clear, actionable information. We are not a lender, but we are experts in helping you navigate the system. Here’s what this means for you.

What Is This New IDR Forgiveness (And Why Is It Happening Now)?

This is not a “new” policy. It is a fix to the existing Income-Driven Repayment (IDR) programs that were first passed in 2007 and took effect in 2009.

- The Original Promise (2009): The IDR plan stated that if a borrower made payments based on their income (around 15% of their “discretionary income”), any remaining loan balance would be forgiven after a certain period (often 10-25 years).

- The Problem: Due to poor record-keeping and complex rules, millions of borrowers who should have been eligible for forgiveness never received it.

- The Solution (The Legal Settlement): A legal settlement between the DOE and the American Federation of Teachers (AFT) has forced the DOE to fix these errors and retroactively grant the forgiveness that was promised.

Who Is Eligible for This Student Loan Forgiveness?

This is a specific group of borrowers. You are likely in this first wave if you meet these criteria:

- You are on an Income-Driven Repayment (IDR) plan.

- You have been in repayment for 10 or more years. (This primarily affects borrowers who started repayment around 2009-2014).

- You have made at least 120 qualifying payments.

This student loan forgiveness action is targeted at those who were part of the original IDR plans and have fulfilled their side of the bargain.

How This Forgiveness Works (and Why It’s Tax-Free)

This is the best part.

- It’s Automatic (Mostly): If you are in the eligible group (1.5–2.1 million borrowers), the DOE is processing this automatically. You should receive an email.

- It’s Tax-Free: Normally, forgiven debt is considered “income” by the IRS, which could lead to a massive, surprise tax bill. However, a 2021 law ensures that all student loan forgiveness granted through 2025 is 100% tax-free at the federal level.

- Timeline: The DOE expects to have all eligible loans processed and discharged by 2025.

What You MUST Do Now (Action Plan)

Do not assume you are (or are not) eligible. Be proactive.

- Check Your Email: Search your inbox (and spam folder) for any official email from the Department of Education (e.g., from an

@ed.govaddress) or your loan servicer. - Log In to StudentAid.gov: This is the most important step. Log in to your official StudentAid.gov account. This is your single source of truth. Check your loan details, payment counts, and messages.

What If You Don’t Qualify for This Student Loan Forgiveness?

This news is exciting, but it’s crucial to understand it is not the “widespread” forgiveness that has been debated. This is a targeted fix for a specific group.

If you are not in this 10-year group, you will not receive an email. But don’t lose hope. This is the perfect time to review your own strategy:

- If you are not eligible, you may need to pursue other strategies. Read our guide on how to pay off student loans faster using methods like Avalanche or Snowball.

- If you are still in school and need funds, make sure you understand all your options, including safer personal loans for students.

This news proves that student loan forgiveness is happening for those who follow the IDR program rules, making it a viable long-term strategy.

The most important step is to be proactive. Log in to your DOE account to verify your status and ensure your contact information is up to date.