Small personal loan vs BNPL for students—what’s truly safer for holiday shopping? If you compare APR vs fees, set a spending cap, and automate repayments, a small personal loan vs BNPL for students can both work. Used poorly, either path can create a 2026 debt hangover. This guide gives you clear comparisons and 11 essential checks to decide with confidence.

Small personal loan vs BNPL for students: the quick reality check

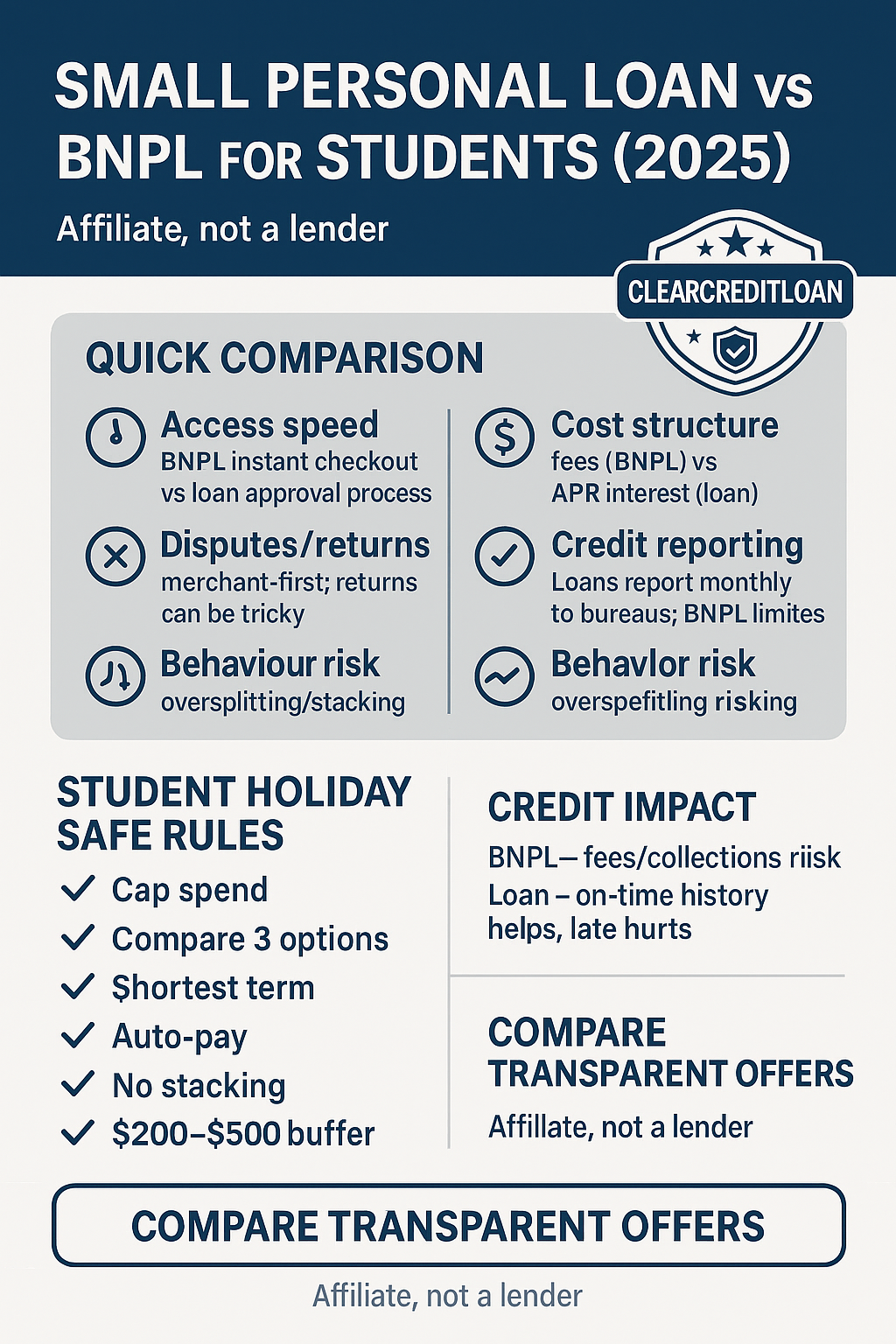

- Access & speed. BNPL appears at checkout with near-instant approvals for small carts. A small personal loan requires an application but can fund a pre-planned list with one fixed payment.

- Cost structure. BNPL “pay-in-4” may advertise no interest yet still charge late fees; a personal loan quotes an APR (rate + certain fees) over a fixed term.

- Returns & disputes. BNPL returns can be messy; you may keep paying while a dispute resolves. Loans are separate from the store—returns don’t change the schedule.

- Credit profile. BNPL may not consistently report; missed payments can still go to collections. Personal loans typically report; on-time payments help, late hurts.

- Behavior risk. BNPL is frictionless and encourages impulse stacking; a loan forces a single budget and a payoff date.

APR vs fees: the holiday math students must check

A “0%” BNPL plan can turn costly with late fees or rescheduling charges. A “low-rate” loan can be expensive if the APR is high or the term is too long. Always compare APR side-by-side with BNPL fee policies. For plain-English guidance on BNPL, see the CFPB explainer

11 essential checks (choose one path and stick to it)

1) Main keyword focus—budget first. Small personal loan vs BNPL for students works only when you set a hard spending cap before you apply or check out.

2) Shortest comfortable term. Shorter terms usually lower total interest (payments are higher).

3) Compare three options. For loans: APR, origination, term, prepayment rules. For BNPL: late fees, reschedule rules, dispute handling, autopay.

4) Automate payments the day after payday or stipend; enable reminders.

5) Hold a $200–$500 micro-buffer so surprises don’t trigger new debt in December/January.

6) No stacking. One small loan or one BNPL plan—do not open multiple lines.

7) Map your credit impact. Personal loans usually report (good for building history if on time). BNPL reporting varies; collections harm credit.

8) Price returns risk. If gifts might be returned, BNPL may leave you paying while a dispute runs; a loan won’t change with returns.

9) Protect essentials. The payment must fit rent/food/transport/insurance without strain.

10) Route windfalls to principal. Send part of year-end gifts or bonus directly to extra principal.

11) Weekly tracking. Compare spend vs list and balance vs schedule; adjust early.

When BNPL can be reasonable (and when it isn’t)

Reasonable with BNPL if: the cart is small, you will repay in 6–8 weeks, autopay is enabled, and the provider’s fees/dispute tools are transparent.

Avoid BNPL if: you tend to stack plans, your income is irregular, or your return window overlaps payments.

When a small personal loan can be smarter (and when it isn’t)

Smarter with a loan if: you want one fixed payment for a planned list, can qualify for a competitive APR, and prefer predictable reporting that can help build credit.

Avoid a loan if: the payment only “works” by stretching the term unreasonably (total interest balloons), fees erase the advantage, or you keep spending on cards afterward.

Student holiday budget split (and how to stick to it)

Try a 40/40/20 split for lean budgets:

- 40% Gifts & wrapping (with a written list and price caps)

- 40% Travel & hosting (or campus experiences)

- 20% Buffer & after-holiday repayment

If travel is already covered, route the surplus to extra principal. Keep a running tally in your notes app and stop at the cap. For practical budgeting tactics that make payments stick, see How to Budget and Save Money.

Credit score impact: small personal loan vs BNPL for students

- BNPL: limited bureau reporting in some cases; late payments can still be sent to collections.

- Personal loan: on-time installments can help establish history; delinquencies and high utilization elsewhere will hurt.

Cost traps students often miss

- Ignoring origination or late fees that change real cost.

- Choosing the lowest monthly payment by extending a term far too long.

- Re-spending on cards after consolidating holiday costs in a loan or BNPL.

- Not automating payments; a single late week can erase any savings. For a refresher on how payments reduce interest and principal over time, see How Amortization Works.

We’re an affiliate, not a lender. Compare transparent offers by APR, fees, and term—or confirm BNPL fee policies—then lock the shortest, affordable plan. Automate it, protect essentials, and start January in control.