Ever look at your bank account and wonder, “Where did all my money go?” You know you should be saving, but impulse buys and overspending keep winning. It’s not a lack of willpower—it’s the psychology of debt.

Overspending isn’t just a “bad habit”; it’s a deep-seated psychological response. Understanding why you spend is the first and most critical step to changing how you spend. As a financial education platform, ClearCreditLoan believes in tackling the root cause of financial stress. We’re here to help you understand the “why” behind your habits and provide a practical, judgment-free strategy to stop overspending for good.

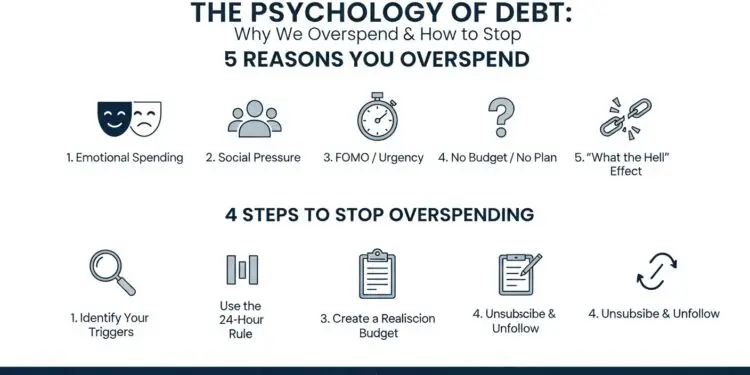

The Psychology of Debt: 5 Core Reasons You Overspend

The psychology of debt is complex. Often, we aren’t buying things; we’re buying feelings. Here are the five most common triggers.

1. Emotional Spending (The “Feel Good” Trap)

This is the most common reason. You had a stressful day at work, so you “deserve” a $200 shopping spree. You feel sad, so you buy something new for a quick “dopamine hit” (a rush of pleasure). In fact, a study published in Psychology & Marketing found that “retail therapy” provides short-term mood boosts, reinforcing the behavior. This is emotional spending.

2. Social Pressure (Keeping Up with the Joneses)

We are social creatures. When we see friends on social media posting about new cars, vacations, or expensive dinners, we feel a powerful urge to keep up. This “social comparison” leads us to spend money we don’t have to project an image of success.

3. “Scarcity” and “Urgency” Marketing (FOMO)

Marketers are experts at exploiting the psychology of debt. Phrases like “Limited Time Only!” or “Only 3 left in stock!” trigger a “Fear of Missing Out” (FOMO). You buy the item not because you need it, but because you’re afraid of the pain of losing the opportunity.

4. Lack of a Plan (No Budget)

This is a simple one: If you don’t have a plan for your money, it’s easy to spend it. Without a budget, you have no “guardrails.” Every decision is an impulse, and it’s impossible to know how to stop overspending because you don’t even know what “overspending” is.

5. The “What the Hell” Effect

This happens when you break your budget by a small amount (e.g., you overspend by $20). You feel like a failure, so you think, “What the hell, the budget is already broken,” and proceed to overspend by another $200. It’s a self-sabotage cycle rooted in the psychology of debt.

The Solution: How to Stop Overspending

You can break the cycle. The solution involves creating “friction” and mindfulness. The CFPB (Consumer Financial Protection Bureau) emphasizes that having a clear plan is the best way to manage debt.

1. Identify Your Triggers (The “Audit”)

For one week, every time you buy something you don’t need, write down what you were feeling right before. Sad? Bored? Stressed? Anxious? Recognizing your triggers is the first step to disarming them.

2. Implement a 24-Hour “Cooling-Off” Period

This is the best way to stop impulse spending. See something you want? Add it to your cart, but do not buy it for 24 hours. After a day, the emotional “high” will have faded, and you can make a logical decision.

3. Create a Realistic Budget (The “Plan”)

A budget is your #1 tool. It gives your money a “job.”

- We strongly recommend our beginner’s guide on how to budget and save money, which covers the 50/30/20 method. It’s a simple, non-restrictive way to start.

4. Unsubscribe and Unfollow

Remove the temptation. Unsubscribe from all “Flash Sale” marketing emails. Unfollow social media accounts that make you feel poor or envious. Curate your environment for financial peace.

What If You’re Already in a High-Interest Debt Cycle?

Understanding the psychology of debt is key to stopping future damage. But what if the damage is already done, and you’re trapped in a cycle of high-interest payday loans or credit card debt?

This is where a debt consolidation loan can be a powerful reset button. This strategy involves taking out ONE new, safer loan (at a much lower fixed APR) to pay off ALL your high-interest debts.

This simplifies your life into one payment and, most importantly, lowers your interest rate so you can finally start paying down the principal instead of just treading water.

Understanding why you overspend is the first step. The next is to create a plan to get out of the debt it caused. If you’re struggling with multiple high-interest payments, consolidation might be your path to freedom.

Read our 5-step guide to debt consolidation to see if this strategy is right for you.