Want to pay off student loans fast? That debt can feel like a heavy backpack you can’t take off. It impacts your ability to save, invest, and build your future. But what if you could lighten the load, starting today?

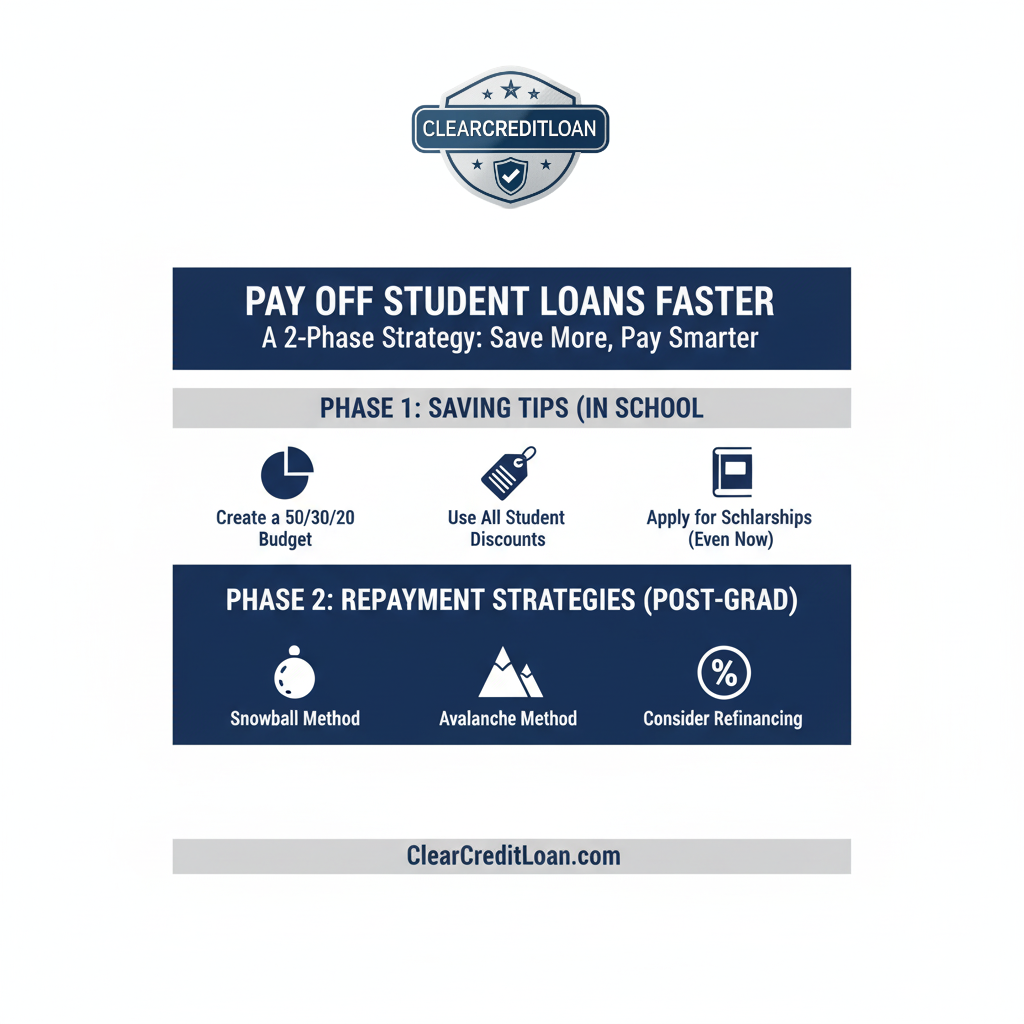

The truth is, learning to pay off student loans isn’t just about making payments; it’s about having a two-part strategy: Phase 1 is learning to save money while you’re still in school (to borrow less), and Phase 2 is attacking the debt after you graduate.

As a financial education platform, ClearCreditLoan is here to give you the clear, unbiased strategies you need. We are not a lender, but we are experts in helping you navigate your options. Let’s break down this actionable guide.

Phase 1: How to Save Money While Still in School

The less you borrow now, the less you have to pay back later. Every dollar you save is a dollar you don’t have to repay with interest.

Create a “50/30/20” Student Budget

- 50% (Needs): Tuition, rent, groceries, transportation.

- 30% (Wants): Eating out, subscriptions, entertainment.

- 20% (Savings/Debt): This is your goal. Put this toward building an emergency fund or even making interest-only payments.

Be Ruthless with Small Expenses

The “latte factor” is real. Small, daily purchases add up. Use student discounts everywhere, learn to cook, and review your bank statements monthly to see where your money is really going.

Phase 2: Strategies to Pay Off Student Loans After Graduation

Once you’ve graduated and your grace period ends, it’s time to attack the principal.

Before you pick a strategy, it’s critical to know what you owe. You can see all your federal loans by logging into your StudentAid.gov dashboard.

Choose Your Attack Method

- The Snowball Method: Pay off your smallest loans first for quick psychological “wins.” This builds momentum and motivation.

- The Avalanche Method: Pay off your loans with the highest interest rates first. Mathematically, this saves you the most money over time.

Make Extra Payments

Whenever you get a bonus, a tax refund, or a cash gift, put a portion of it directly toward your loan’s principal. This is the simplest way to pay off student loans faster.

The “Accelerator”: Refinancing to Pay Off Student Loans Fast

For many graduates with good credit (or a cosigner) and a stable income, refinancing can be a powerful tool to pay off student loans fast.

What is Refinancing?

Student loan refinancing is the process of taking out a new private loan to pay off your existing federal and/or private loans. The goal is to get a new loan with a lower interest rate.

Pros:

- Lower Interest Rate: This is the #1 reason. A lower rate means you pay less interest over the life of the loan.

- Simplified Payments: You combine multiple loans into one single monthly payment.

Cons (Crucial Warning):

- Loss of Federal Protections: If you refinance federal loans into a private loan, you permanently lose access to federal benefits like income-driven repayment (IDR) plans and loan forgiveness.

Refinancing isn’t for everyone, but for the right person, it can save thousands. The key is to know your options.

Ready to see if you can get a lower rate? Compare personalized refinancing offers from our top-rated partners. It’s free, fast, and won’t impact your credit score.