Do you feel like you’re working hard but never getting ahead? Does your paycheck disappear before the next one arrives? You’re not alone. The secret isn’t just earning more—it’s learning how to budget and save money effectively. This is the single most important skill for building wealth.

Budgeting isn’t about restriction; it’s about control. It’s a plan that tells your money where to go, instead of wondering where it went. As a financial education platform, ClearCreditLoan believes that a solid budget is the foundation of financial health. This guide will teach you, step-by-step, how to budget and save money, define your goals, and create a sustainable strategy to achieve them.

Why Is Learning How to Budget and Save Money So Important?

A budget is the ultimate E-A-T (Expertise, Authoritativeness, Trustworthiness) tool for your own life. It builds trust in your financial decisions.

Without a plan, it’s easy to fall into debt or feel financial stress, which are the primary pain points of living with bad credit. Learning how to budget and save money gives you:

- Control: You are the boss of your money, not the other way around.

- Freedom: You have the freedom to spend on things you truly value (your “right purpose”).

- Security: You can build an emergency fund to handle unexpected curveballs, avoiding the need for high-interest debt.

- Clarity: You finally see exactly where your money is going.

Step 1: Understand Your Income vs. Expenses (The “Audit”)

You can’t create a map without knowing your starting point.

- Calculate Your Total Monthly Income: This is your net pay (after taxes) from all sources.

- Track Your Expenses: For one week (or even a month), track every single dollar you spend. Use an app or a simple notebook. Be honest. This will be an eye-opening experience.

- Categorize Your Spending: Group your expenses into “Needs” (rent/mortgage, utilities, groceries, gas), “Wants” (dining out, streaming, shopping), and “Savings/Debt” (loan payments, 401k).

The Consumer Financial Protection Bureau (CFPB) offers excellent free worksheets to help you get started with this step.

Step 2: Use Your Money for the Right Purpose (Set Goals)

Now that you know where your money is going, you can decide where you want it to go. Using money “for the right purpose” means aligning your spending with your values.

- Right Purpose (Investment/Needs): Paying down high-interest debt, building an emergency fund, saving for a down payment, or investing in your education. This is similar to the concept of what students should borrow money for —it’s about investing in your future.

- Wrong Purpose (Unplanned Consumption): Impulse buys, daily $7 lattes, subscription services you don’t use.

Your goal isn’t to cut out all “Wants,” but to make them intentional.

Step 3: Choose Your Budgeting Method

There is no single “best” way for how to budget and save money. The best method is the one you will actually stick with.

1. The Envelope System (for Cash Spenders)

You pull out cash for your “Want” categories (like “Groceries,” “Dining Out”) and put it in labeled envelopes. When the envelope is empty, you’re done spending in that category for the month.

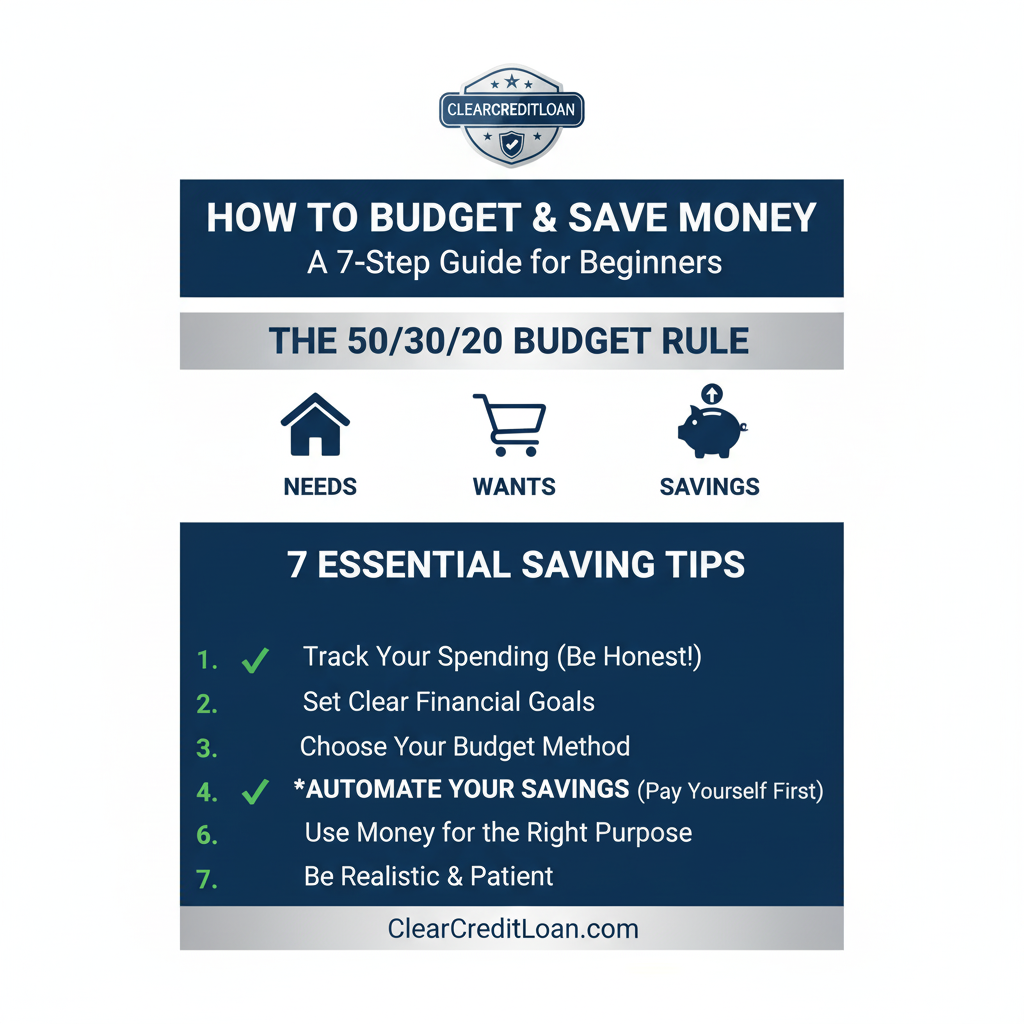

2. The 50/30/20 Method (Recommended for Beginners)

This is a simple, flexible guideline popularized by Senator Elizabeth Warren. You divide your after-tax income:

- 50% for Needs: Rent, utilities, groceries, insurance, car payments.

- 30% for Wants: Dining out, hobbies, shopping, entertainment.

- 20% for Savings & Debt: Paying off loans, saving for retirement, building an emergency fund.

3. Zero-Based Budgeting (for Control Freaks)

With this method, you give every single dollar a “job” at the beginning of the month. Your income minus your expenses (including savings and debt payments) must equal zero. This is the most detailed but also the most powerful method.

Step 4: Automate Your Savings (The Best Tip)

This is the secret to how to budget and save money successfully: Pay yourself first.

Before you pay any bills or buy any groceries, set up an automatic transfer from your checking account to your savings account for the day you get paid.

Even if it’s only $50 per paycheck, this ensures you save money before you have a chance to spend it.

Step 5: Review and Adjust (Be Realistic)

Your first budget will fail. And that’s okay. You’ll overspend on groceries or forget a subscription. The key is to review your budget at the end of the month, see what went wrong, and adjust the plan for next month. A budget is a living document, not a stone tablet.

Learning how to budget and save money is the ultimate solution to long-term financial health. But if you’re already in a tough spot from past habits, budgeting alone can feel like digging out of a hole.

If you’re currently struggling with high-interest debt, a bad credit loan might be a tool to consolidate those payments and get a fresh start—but only after you have a budget in place to manage the new payment.

ClearCreditLoan can help. Compare pre-vetted loan partners that specialize in bad credit loans. See your options for free without impacting your score.