Needing emergency loans for students is a stressful, frightening position to be in—especially if you have bad credit. Your car breaks down, you have an unexpected medical bill, or you’re short on rent. You need cash now, and “fast cash” payday lenders know you’re desperate.

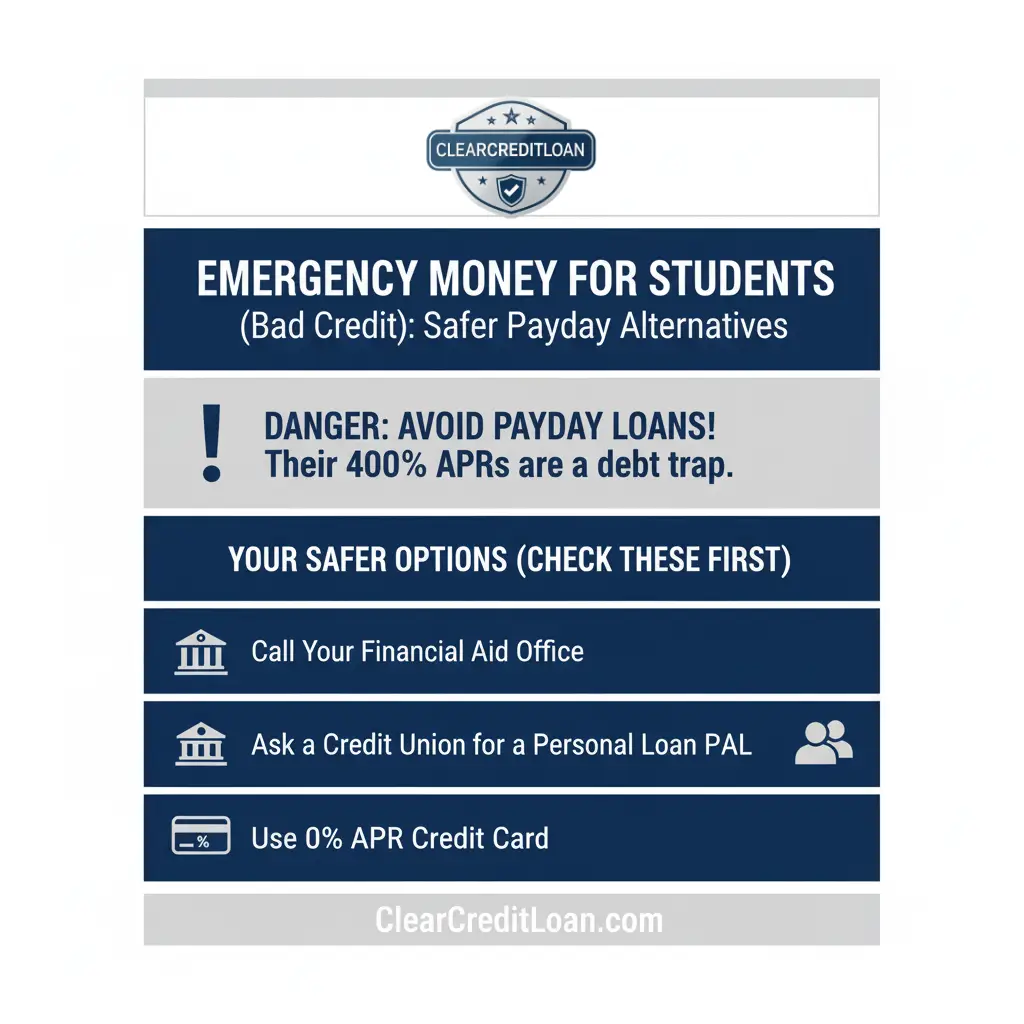

This is a critical moment. Choosing the wrong loan can trap you in a spiral of debt with 400% interest rates. As a financial education platform, ClearCreditLoan is here to protect you from that. We are not a lender. Our mission is to show you the safer payday alternatives that exist for students, even with bad credit. Let’s compare your safest options.

The Ultimate Trap: Why Students MUST Avoid Payday Loans

Before we explore alternatives, you must understand the danger. Payday loans are advertised as “easy cash” and “no credit check” emergency loans for students.

However, they are a trap. As the Consumer Financial Protection Bureau (CFPB) warns, these loans have extremely high APRs (often 400%+) and are designed to be almost impossible to pay back on time, forcing you to “roll over” the loan and pay even more fees.

You have better options.

5 Safer Payday Loan Alternatives for Students (Even with Bad Credit)

Here are the safer options you should explore FIRST.

1. Credit Union PALs (Payday Alternative Loans)

If you are a member of a credit union, this is your #1 best option. Credit unions are non-profits, and many offer PALs.

- What they are: Small loans (e.g., $200 – $2,000) with interest rates capped by federal law.

- National Credit Administration (NCUA): These are specifically designed to be a safe alternative to predatory payday loans.

2. A Reputable Personal Loan (with a Cosigner)

Your bad credit makes it hard to get a loan alone. However, a cosigner (like a parent or trusted relative) with good credit can help you secure a safe personal loan for students.

- How it works: They agree to pay the debt if you can’t. This “borrows” their good credit, giving you access to fair interest rates.

- We wrote a full guide on how personal loans for students work that you should read.

3. 0% APR Credit Card (Cash Advance or Purchase)

If you have a credit card, check if it has a 0% introductory APR offer.

- For Purchases: If your emergency is a purchase (like a new laptop), you can buy it and pay 0% interest for 12-18 months.

- For Cash: A “cash advance” from your card is usually expensive, BUT it is still far cheaper than a payday loan.

4. Financial Aid Office / University Emergency Fund

Many universities have their own “Student Emergency Funds” or short-term loans for students in crisis. Call your financial aid office immediately. They are there to help you, often with interest-free loans or grants.

5. Reputable Online Lenders (As a Last Resort)

Some reputable online lenders (NOT payday lenders) specialize in bad credit loans for students. Their rates will be higher than a credit union, but they are regulated, transparent, and have much lower APRs than a payday lender.

- We discussed some of these safer online options in our low-income guide.

How to Compare Emergency Loans for Students

When you’re in a panic, it’s easy to miss the fine print. Always check these 3 things:

- APR (Annual Percentage Rate): This is the true cost. A payday loan is 400%+. A “bad” personal loan might be 36%. 36% is much, much better than 400%.

- Origination Fees: Does the lender charge a fee just to give you the money?

- Repayment Term: Do you have months to pay it back (good) or just two weeks (bad, like a payday loan)?

Being a student with bad credit is tough, but you are not out of options. Don’t let a short-term emergency create a long-term debt nightmare.

ClearCreditLoan helps you compare reputable, pre-vetted personal loan partners that are safer alternatives to payday loans. See your options for free.