Are you trapped in the cycle of high-interest or “predatory” loans? That crushing feeling when your entire paycheck is gone, but the loan balance barely budges? You are not alone. This is a trap designed to be hard to escape. But there is a powerful solution: debt consolidation for high-interest loans.

Living with high-interest debt is a constant state of emergency. The stress is overwhelming, and it feels like there’s no way out. As a financial education platform, ClearCreditLoan is here to provide an empathetic, unbiased, and expert-backed path forward. We are not a lender. We are here to show you a proven strategy to break the cycle.

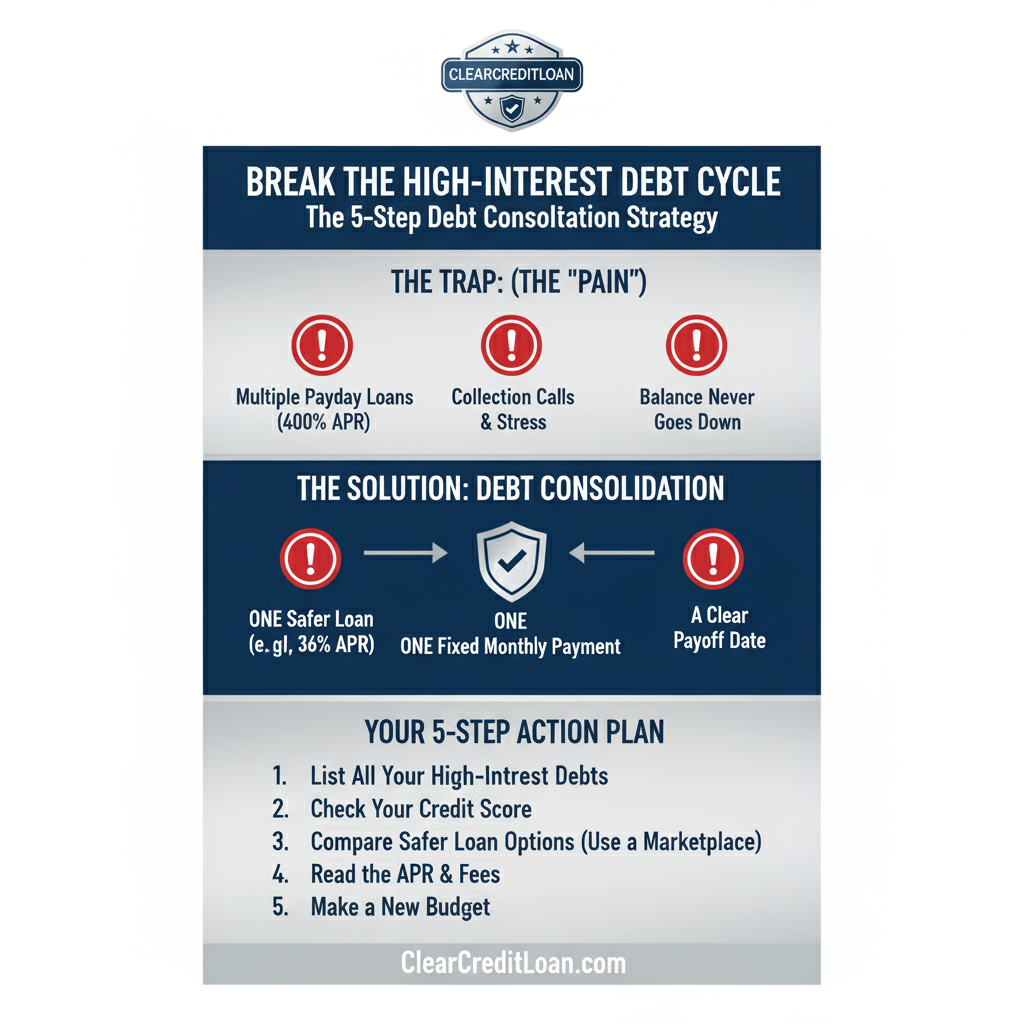

The Crushing Pain of the High-Interest Debt Trap

Predatory lending isn’t just about high APRs; it’s about the real-world pain it causes.

- The “Rollover” Treadmill: You pay a massive fee just to “roll over” your payday loan, meaning you haven’t touched the principal.

- The Math Doesn’t Work: With APRs at 100%, 200%, or even 400%+, your payments are all interest. The principal balance never goes down.

- Constant Harassment: The stress of collection calls and wage garnishment threats is debilitating.

- The Hopeless Cycle: As the CFPB (Consumer Financial Protection Bureau) warns, these loans are designed to trap you. You’re forced to take out a new loan just to pay off the old one.

What Is Debt Consolidation for High-Interest Loans (And How Does It Work)?

Debt consolidation is a strategy, not a specific product. It means taking out one new, safer loan to pay off all of your multiple, high-interest loans.

Instead of 5 different payday loans or credit cards charging you 100%+ APR, you now have:

- One single monthly payment.

- One lower, fixed interest rate (e.g., 25-36% APR).

- One clear end date (a “repayment term”).

Yes, 36% APR is still high, but it is infinitely better than 400% APR. A 36% APR loan allows you to actually pay down the principal and get out of debt.

A 5-Step Guide to Using Debt Consolidation Safely

Using debt consolidation for high-interest loans is the “best solution,” but it must be done responsibly.

Step 1: Face the Numbers (The “Pain Audit”)

You cannot fix what you can’t see. Make a list of every single high-interest debt you have: who you owe, how much you owe, and (most importantly) the APR. This number will be scary, but it’s your motivation.

Step 2: Check Your Credit Score (Know Your Standing)

Your credit score will determine what kind of consolidation loan you can get. If you have multiple payday loans, your credit is likely low. That’s okay—the options we discuss are for people with bad credit. Get your free report from AnnualCreditReport so you know your starting point. This is the first step in fixing the pain of guide to living with bad credit .

Step 3: Compare “Safer” Debt Consolidation Loans

This is where you take action. You are looking for a personal loan for debt consolidation. Do not just go to another payday lender. You must use a reputable loan marketplace.

- Why? Marketplaces (like our partners

Honestloans,Cashfinance, etc.) use a “soft pull” (no credit score impact) to let you compare offers from multiple lenders who specialize in bad credit loans. - You can read our review of bad credit loan platforms to see how they work.

Step 4: Read the Fine Print (APR is King)

When you get an offer, ignore the “low monthly payment” and look ONLY at the APR and the Origination Fee. A 5% origination fee on a $5,000 loan is $250! Choose the loan with the lowest combined cost.

Step 5: Have a Post-Consolidation Plan

Getting the new loan is only half the battle. You MUST have a plan to stop the old habits. This means creating a budget to manage your new, single payment and avoid taking on new high-interest debt.

- A budget is essential. Read our guide on how to budget and save money to create a plan that works.

You are not trapped. You have a clear, strategic path to escape the pain of high-interest debt. The first step is to see what safer options are available.

ClearCreditLoan can help. Use our free, secure tool to compare pre-vetted loan partners that specialize in debt consolidation for high-interest loans. See your options without impacting your credit score.