Finding the best loans for students with bad credit can feel impossible. Traditional banks often say “no,” and predatory payday lenders are waiting to trap you. When you’re a student or have a poor credit history, where can you turn for a safe, fair option?

As a student, you have a “thin credit file” (little to no history). If you have bad credit, you’re seen as “high-risk.” In both cases, applying for loans one-by-one is frustrating and can hurt your score.

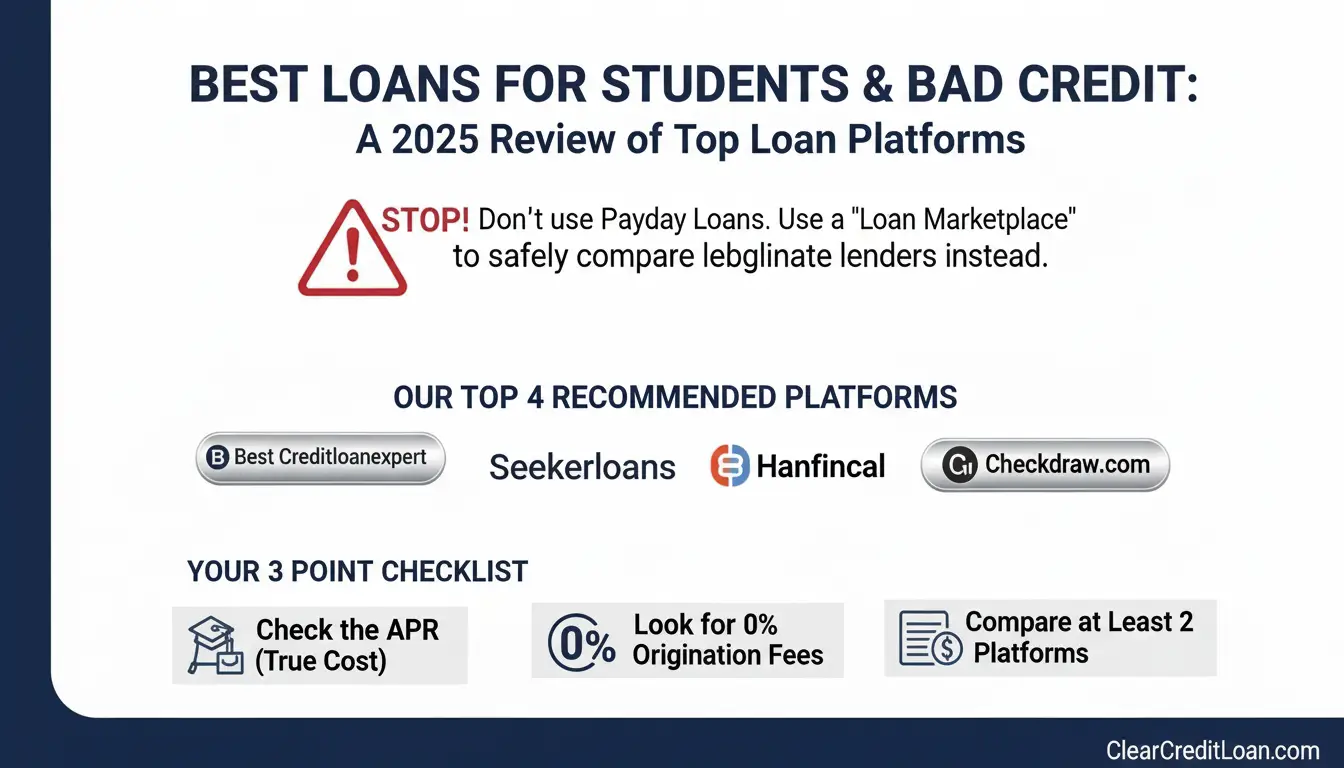

This is where loan marketplaces become your most powerful tool. Instead of one bank, they check your eligibility against dozens of different lenders—many of whom specialize in helping students and people with bad credit.

As a financial comparison site, we’ve reviewed the top players. This guide compares 4 of our recommended loan platforms to help you find the best loans for students with bad credit by checking your rates on one of these 4 platforms.

Why Is It So Hard for Students with Bad Credit to Get Loans?

When a bank sees an application from a student or someone with a low FICO score, they see uncertainty. That’s why finding the best loans for students with bad credit requires looking outside of traditional banks.

According to the CFPB (Consumer Financial Protection Bureau), a low score signals risk to the lender. This is why standard banks say no, and why you must avoid payday loan alternatives that charge 400% APR.

The platforms below are not payday lenders. They are marketplaces designed to find you a legitimate personal loan.

Our Top 4 Platforms for the Best Loans for Students with Bad Credit

We’ve analyzed our partners to find the best options for this specific audience. Here is our review.

1. Offer A

Offer A is a large, established network. Its main strength is the sheer size of its lender marketplace, which increases your chances of getting matched, even with a challenging credit file.

- Best For: Overall comparison and finding multiple options.

2. Offer B

Offer B has built a reputation for its user-friendly interface. We find their process to be one of the simplest for first-time borrowers (like students) to navigate. They are excellent at matching borrowers with lenders offering flexible terms, especially for those seeking the best loans for students with bad credit

- Best For: First-time borrowers and flexible repayment options.

3. Offer C

Offer C is a newer player that seems to have a strong focus on niche lenders. While its network may not be as large as others, it often finds unique “specialty” lenders that are specifically willing to work with students or those needing to build credit.

- Best For: Finding niche lenders that understand student/bad credit profiles.

4. Offer D

Offer D primary advantage is speed. Their application process is streamlined to give you a “yes” or “no” from their partners very quickly. For students facing an emergency, this speed is a significant benefit.

- Best For: Fast application process and quick decisions.

Final Verdict: What’s the Best Loan for Students with Bad Credit?

The “best” loan is simply the one with the lowest APR (Annual Percentage Rate) that you can qualify for.

No single platform is “best” for everyone. The smartest strategy to find the best loans for students with bad credit is to compare offers from at least two of these platforms.

Because they use a “soft pull,” you can check your rates on all four sites without hurting your credit score. Start with one, and if you don’t like the offer, try another. This is the only way to ensure you aren’t leaving a better deal on the table.