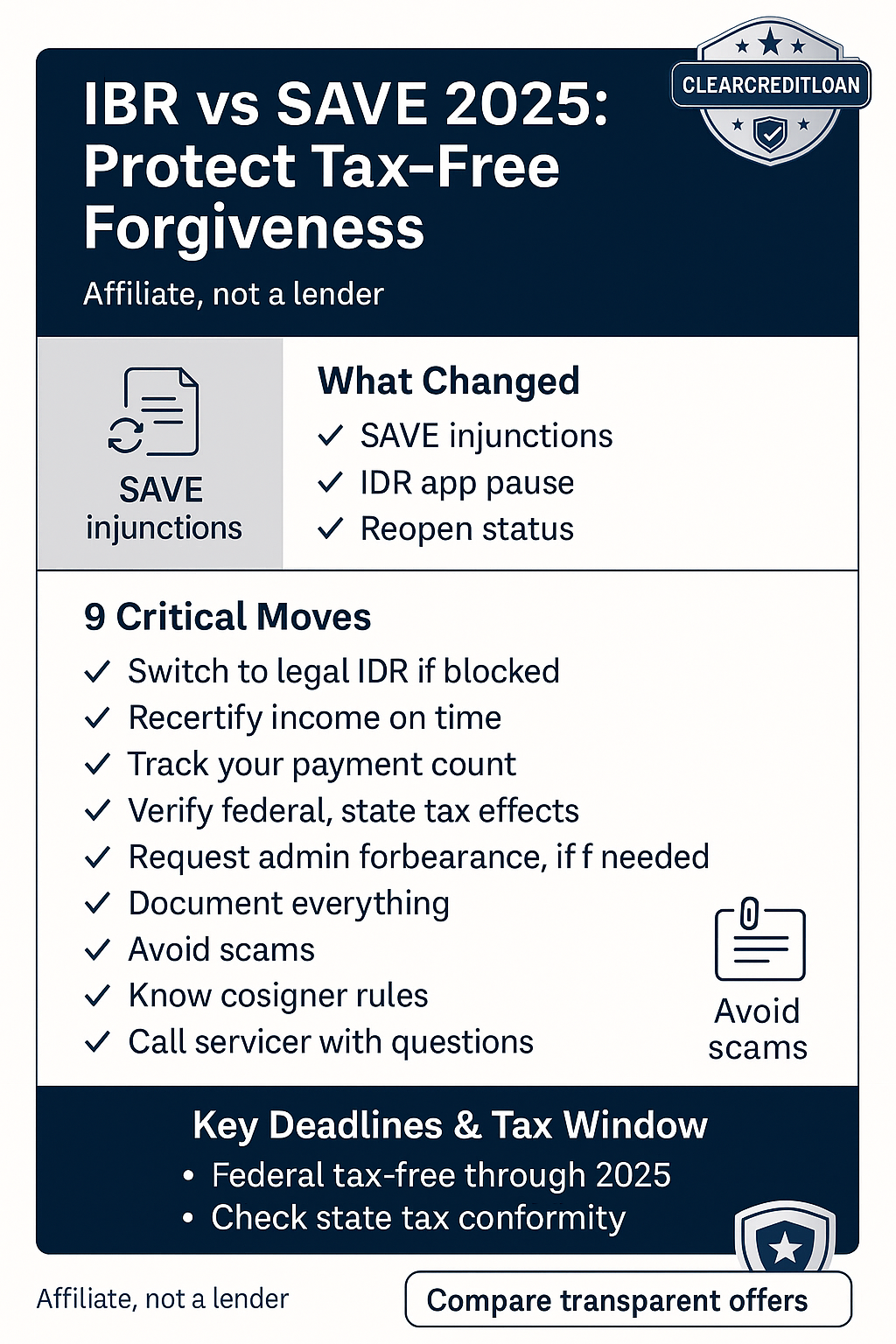

IBR vs SAVE 2025 isn’t a niche debate anymore. With court orders disrupting SAVE and the federal tax-free window for student loan forgiveness set to end after December 31, 2025, borrowers need a clear, low-risk plan—fast. This guide explains what’s blocked, what still works, and nine critical moves to keep your path to forgiveness intact.

What changed: court actions and the IBR vs SAVE 2025 landscape

- Multiple court rulings in 2024–2025 restricted or blocked SAVE features, forcing millions to reconsider repayment strategy. Federal guidance directs borrowers to compare legal IDR options (e.g., IBR) and resume progress toward forgiveness rather than waiting indefinitely. (See official updates at StudentAid.gov and Education Department releases.)

- The unified IDR application was paused and later reopened in 2025, creating backlogs and confusion for borrowers trying to switch plans or recertify. If you were stuck, applications have resumed—but processing may still lag.

The federal tax-free clock (and why 2025 matters)

- Under federal law, most student loan discharges are excluded from federal taxable income for loans forgiven from 2021 through the end of 2025. Unless extended by Congress, forgiveness after 2025 may again be federally taxable.

- State taxes can differ. Some states conform to federal rules; others may tax forgiven amounts. Always check your state revenue agency guidance before counting on “tax-free.”

IBR vs SAVE 2025: practical differences for a crisis year

- SAVE (limited/blocked): Portions of SAVE—including $0 interest protections or accelerated forgiveness rules—have been curtailed by injunctions. Many borrowers in SAVE were placed in forbearance and told to evaluate other legal plans to keep earning qualifying payment credit.

- IBR (preserved): IBR remains available and is expected to continue. If SAVE blocks prevent your payments from counting, switching to IBR can re-start qualifying payment accrual toward IDR or PSLF (subject to program rules).

- PSLF and other IDR paths: PSLF still relies on qualifying payments while working for eligible employers. If SAVE interruptions halted your progress, moving to a legal IDR plan (often IBR) keeps the clock running.

9 critical moves to protect tax-free forgiveness in 2025

1) Confirm your plan status today. If SAVE left you in litigation forbearance or paused progress, compare IBR immediately using the Loan Simulator and your latest income.

2) Switch to a legal IDR if blocked. If you can’t accrue qualifying payments under SAVE, enroll in IBR (or another legal IDR) so time toward forgiveness (or PSLF) continues.

3) Recertify income on time. Reopenings in 2025 created backlogs; build buffer time. Keep copies of submissions and servicer messages.

4) Track your IDR payment count. Use your servicer dashboard and save screenshots. If you consolidate, confirm how counts transfer.

5) Mind the 2025 federal tax window. If you’re near forgiveness, understand that federal tax-free status is scheduled only through December 31, 2025; plan timing accordingly.

6) Check state tax rules. Your state might tax forgiven debt even if the federal government does not in 2025.

7) Avoid delinquency during transitions. If processing delays occur, request administrative forbearance in writing and ask that PSLF/IDR credit be preserved where applicable.

8) Document everything. Court-driven changes mean policy updates shift quickly; keep a folder of PDFs/emails for disputes and appeals.

9) Beware scam “fixers.” No one can “unlock” SAVE or sell guaranteed forgiveness. Use official .gov channels.

Decision guide: should you move from SAVE to IBR right now?

- Move now if: your SAVE plan is paused or not earning qualifying payment credit, your employer qualifies for PSLF, or you’re within 12–24 months of IDR forgiveness.

- Wait/monitor if: you’re mid-appeal on a specific SAVE benefit and have written confirmation that your qualifying months continue (rare—double-check).

- Double-check PSLF rules: Employer eligibility, full-time status, and on-time payments are still required regardless of plan—you just need to be on a qualifying IDR (IBR qualifies).

Common pitfalls to avoid in 2025

- Assuming tax-free beyond 2025. Unless Congress extends it, federal tax-free forgiveness ends after 2025; plan for possible tax exposure in 2026 and beyond.

- Ignoring state taxes. Non-conforming states may tax forgiven balances.

- Staying stuck on SAVE. If court orders block progress, inaction can cost you months of qualifying time.

- Trusting unofficial guidance. Only rely on StudentAid.gov and servicer notices for binding instructions.

We’re an affiliate, not a lender. Use the Loan Simulator to compare IBR vs SAVE 2025 options, enroll in a legal IDR plan (often IBR) if you’re blocked, and keep meticulous records. Then verify tax impacts (federal and state) before year-end. For budgeting tactics that help you stay current, see How to Save Money and Pay Off Student Loans Fast and for the policy context see Student Loan Forgiveness: IDR Settlement.