Student loan borrowing tips matter more than ever: the wrong loan can follow you for a decade, while a well-chosen plan funds your studies and protects your credit. This guide gives students a step-by-step playbook—from APR and fees to cosigners, credit impact, and repayment planning—so you borrow only what you need and pay it back with confidence.

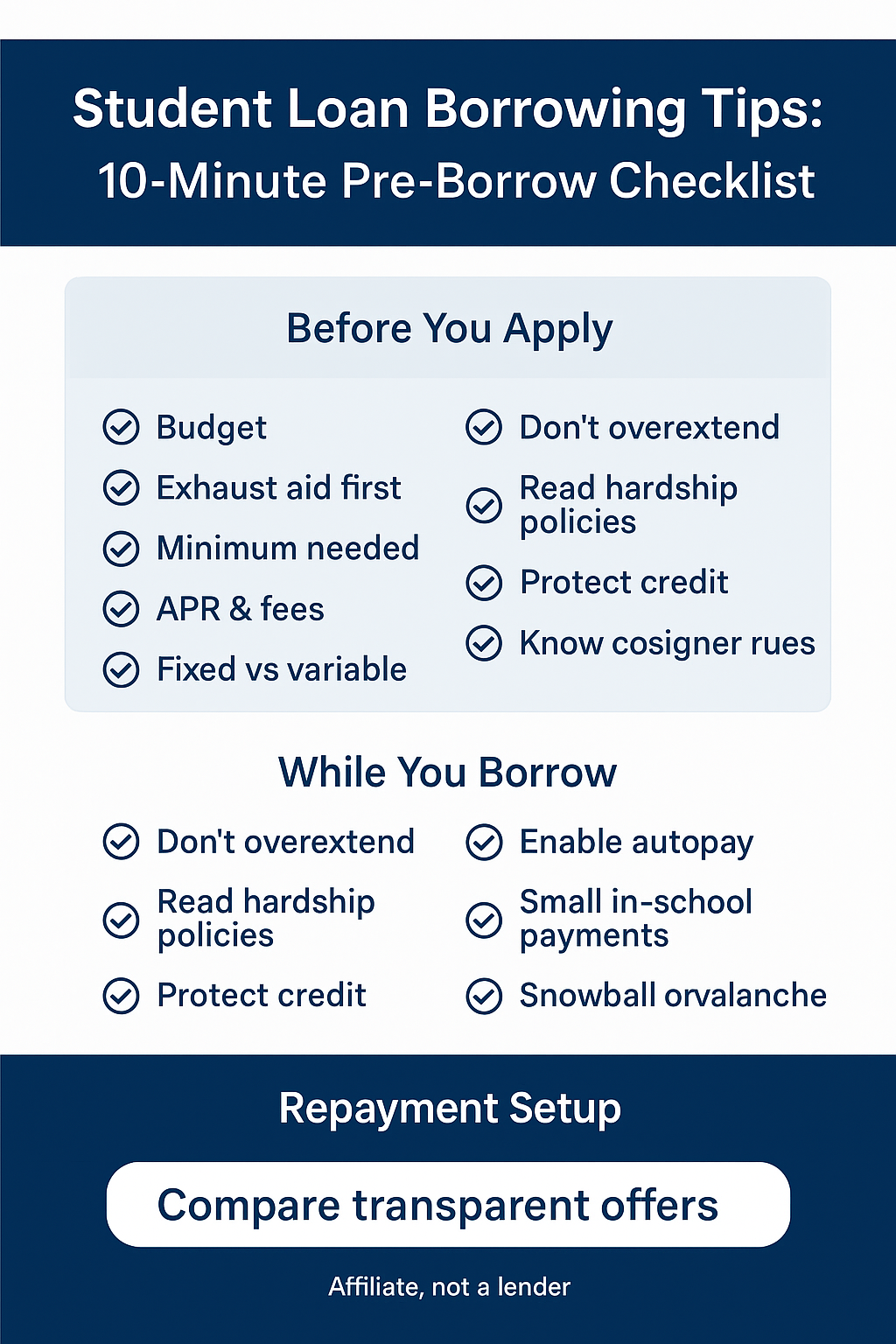

Student loan borrowing tips: a 10-minute plan before you apply

1) Write your real budget first. Map rent, food, transport, books, and a small buffer. If it doesn’t fit on paper, it won’t fit in life. For day-to-day tactics that make payments stick, review How to Budget and Save Money.

2) Exhaust lower-cost aid. Grants/scholarships/work-study beat loans.

3) Prefer federal over private when eligible: income-driven repayment, deferment/forbearance options, and potential forgiveness programs are valuable safety nets.

4) Borrow the minimum needed (tuition gap + lean living)—not the maximum offered.

5) Check total cost, not just the payment. Compare APR (rate + certain fees) and model the term; a longer term can multiply total interest.

6) Decide on fixed vs variable. Fixed provides predictability; variable can rise.

7) Plan your repayment route now. Set an auto-pay date that matches cashflow; aim to add a small recurring extra once you’re employed.

Federal vs private vs student personal loans (and when each fits)

- Federal loans: Often first choice due to income-driven plans, deferment, and clearer protections. Great for uncertainty while you establish income.

- Private student loans: Consider only after federal options; compare APR, fees, cosigner release terms, and hardship policies.

- Student personal loans (or general personal loans): Use sparingly for short, specific gaps (e.g., relocating for an internship) when the APR is competitive and the payoff window is short. For a deeper overview of safer student-focused options, see Student Personal Loans: A Guide to Safer Options.

APR, fees, and capitalization—what changes the real price

- APR vs interest rate: APR includes the rate plus certain fees (e.g., origination), so it’s the fair way to compare.

- Capitalization risk: Interest that accrues during school/forbearance may be added to principal, increasing future interest.

- Term length trade-off: Longer terms lower monthly payments but often raise total interest dramatically.

- Prepayment rules: Prefer loans with no prepayment penalties so you can accelerate once income rises.

Cosigners: power and risk

A cosigner can unlock approval and lower APR—but they’re equally liable. Missed payments hit both credit reports, and releasing a cosigner often requires a string of on-time payments and a new credit check. Only use a cosigner if your repayment plan is robust and you’re willing to share statements transparently.

Credit score impact for students

- Opening a loan: Expect a small, temporary dip from a hard inquiry; building on-time history matters more over time.

- Utilization dynamics: Installment loans don’t weigh like revolving cards; however, late payments can seriously damage scores.

- Autopay & alerts: Set autopay the day after stipend/payday and enable text/email reminders to prevent accidental lates.

Repayment planning: design it before day one

1) Autopay + calendar holds. Treat payments like non-negotiable bills.

2) Snowball vs avalanche. If you carry multiple debts, choose either: avalanche (highest APR first) or snowball (smallest balance for quick wins).

3) Use windfalls wisely. Route a portion of scholarships refunds, tax refunds, or part-time income to extra principal.

4) Grace period strategy. If you have a grace period, $25–$50 monthly toward interest keeps capitalization in check.

5) Refinance carefully after graduation. Only if APR drops and you won’t lose federal protections you still need.

Red flags to avoid (common student pitfalls)

- “Guaranteed approval / no credit check” loan pitches, up-front fees, or pressure to act today.

- Variable-rate loans with teaser pricing and no cap.

- Borrowing for lifestyle upgrades (new gadgets/fashion) instead of academic needs.

- Letting small missed payments roll—fees add up and credit damage lasts.

17 smart rules—quick checklist

1) Budget first; 2) Prefer federal; 3) Borrow minimum; 4) Compare APR, not just rate; 5) Watch fees; 6) Choose fixed if unsure; 7) Keep term as short as you can afford; 8) Avoid capitalization (small in-school payments help); 9) Read hardship policies; 10) Use cosigner only with a plan; 11) Protect both credit files; 12) Automate payments; 13) Build a tiny emergency buffer; 14) Route windfalls to principal; 15) Don’t stack credit cards while repaying; 16) Refinance only when total cost drops; 17) Re-check your budget each term.

We’re an affiliate, not a lender. Compare transparent, student-friendly options by APR, fees, and term. Choose the shortest affordable plan, automate payments from day one, and use budgeting tactics to protect your progress.