Credit card debt consolidation is surging in 2025 as balances hit records and APRs stay stubbornly high. Done right, credit card debt consolidation can trade today’s floating, punishing interest for one fixed-rate plan with a clear payoff date. Done wrong, it simply reshuffles debt and adds fees. This guide shows you when consolidation works—and the exact steps to make it pay.

Why credit card debt consolidation is booming in 2025

- Record balances meet record-like APRs. Households are carrying historic credit card balances while average card APRs hover around the low-20s. That math is brutal.

- Consumers want predictability. A fixed-rate personal loan (or a structured debt management plan) replaces many variable-rate card bills with one set payment.

- Lenders are promoting consolidation. Major lenders and platforms market “debt consolidation loans” because they convert revolving debt into installment loans with known risk.

Want the source charts? See the New York Fed’s Household Debt & Credit report for Q3 2025

When credit card debt consolidation makes sense

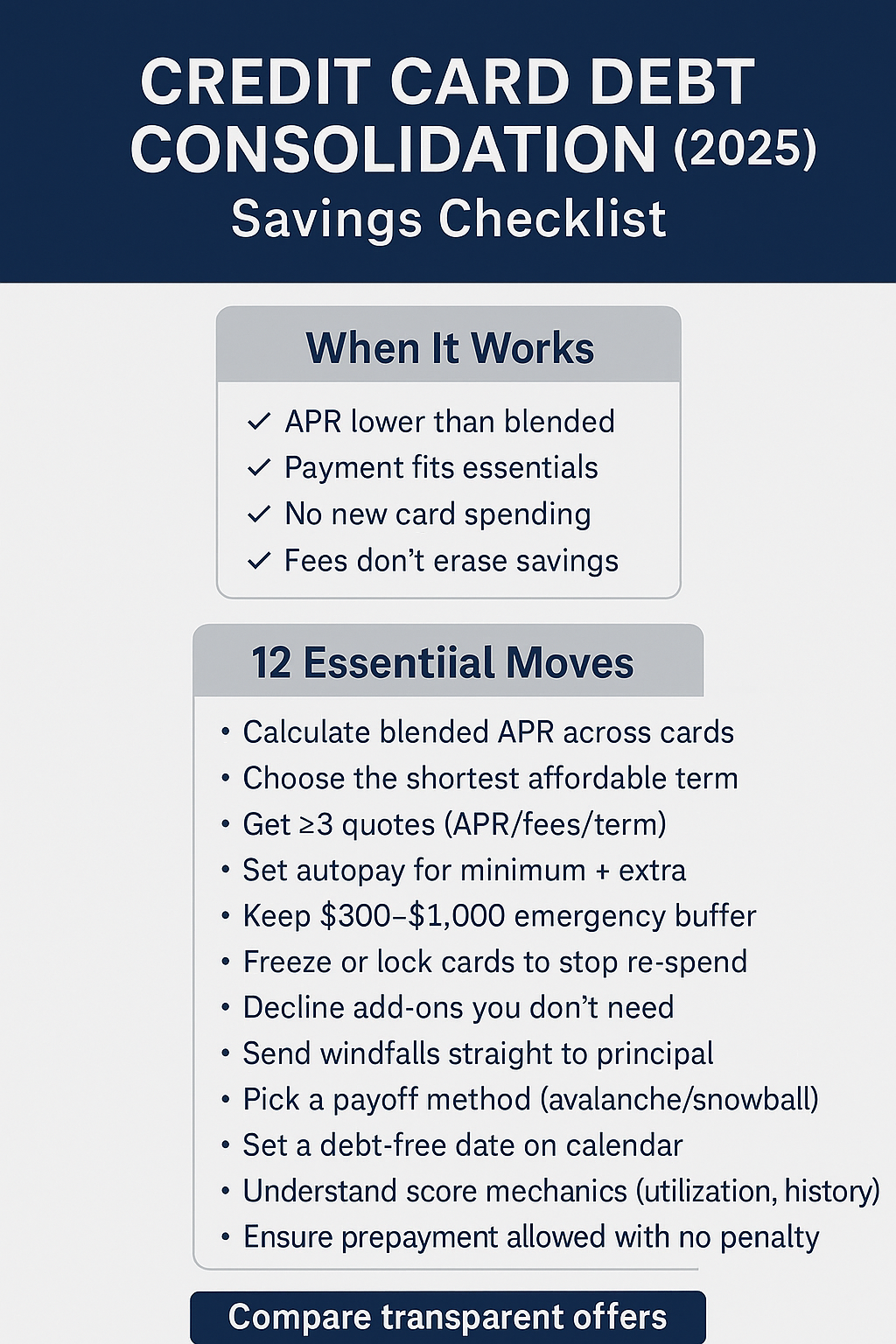

Choose consolidation if all are true:

1) You can qualify for a fixed APR meaningfully below your blended card APR.

2) The new monthly payment fits after rent/food/transport/insurance.

3) You commit to no new card spending until the loan is repaid.

4) Fees (origination/balance-transfer) don’t erase the interest savings.

If any of these fail, consider a Debt Management Plan (DMP) with a nonprofit, or a short-term budget reset before applying.

12 essential moves to do credit card debt consolidation right

1) Calculate your blended APR. Weight each card’s APR by balance; compare against the consolidation APR + fees.

2) Pick the shortest affordable term. Shorter terms raise the payment but slash total interest.

3) Get three quotes. Personal loan (APR, fees, prepayment rules), a 0% intro balance transfer (transfer fee, promo length), and a DMP quote.

4) Automate payments the day after payday; set calendar reminders.

5) Close the loop on spending. Freeze cards you’re consolidating to prevent backsliding.

6) Attack fees. Avoid add-ons you don’t need (extra insurance, “expedite” fees).

7) Build a $500 starter buffer. Small cushion prevents new swipes when surprises hit.

8) Choose your payoff method. Avalanche (highest APR first) or snowball (smallest balance first) for any leftover balances.

9) Route windfalls to principal. Tax refund, bonus, side-gig cash—send part straight to principal.

10) Track your debt-free date. Seeing the end date keeps you motivated; recalc after extra payments.

11) Watch credit score mechanics. Installment utilization doesn’t weigh like revolving; on-time history helps, missed payments hurt.

12) Prepay without penalty. Prefer loans that let you pay off early at no extra cost.

Personal loan vs 0% balance transfer: which fits you?

- Personal loan (fixed-rate). Predictable payment, timeline, and reporting. Best when the fixed APR beats your blended card APR and you don’t qualify for long 0% promos.

- 0% balance transfer. Great if you can clear the balance before promo ends; but transfer fees and post-promo rates can bite.

- DMP (nonprofit). If approval odds are low or rates are high, a DMP may reduce interest and structure payments without a new loan.

Risks to avoid (how consolidation backfires)

- Stretching to a very long term just to “shrink” the payment → total interest balloons.

- Paying a high origination fee that wipes out savings.

- Consolidating today but continuing to spend on the same cards.

- Missing payments (automatic late fees + credit damage).

For a refresher on how payments reduce principal vs interest over time, see How Amortization Works.

Simple worksheet to sanity-check savings

- List each card’s balance + APR → compute monthly interest cost.

- Quote loan APR/fees/term → compute total interest paid.

- Break-even: if loan total interest + fees < status-quo card interest over the same period, consolidation likely helps.

For habit fixes that make payments “stick,” see How to Budget and Save Money.

We’re an affiliate, not a lender. Compare transparent offers, pick the shortest affordable fixed rate that beats your current blended APR, and automate payments. Then lock your cards, build a buffer, and get your debt-free date on the calendar.