BNPL vs personal loans: which is safer for holiday shopping in 2025? The smart answer depends on price (APR vs fees), discipline, and how quickly you’ll repay. Used well, either option can smooth cash flow. Used poorly, both can cause a 2026 debt hangover. This guide compares BNPL vs personal loans and gives you a step-by-step decision checklist.

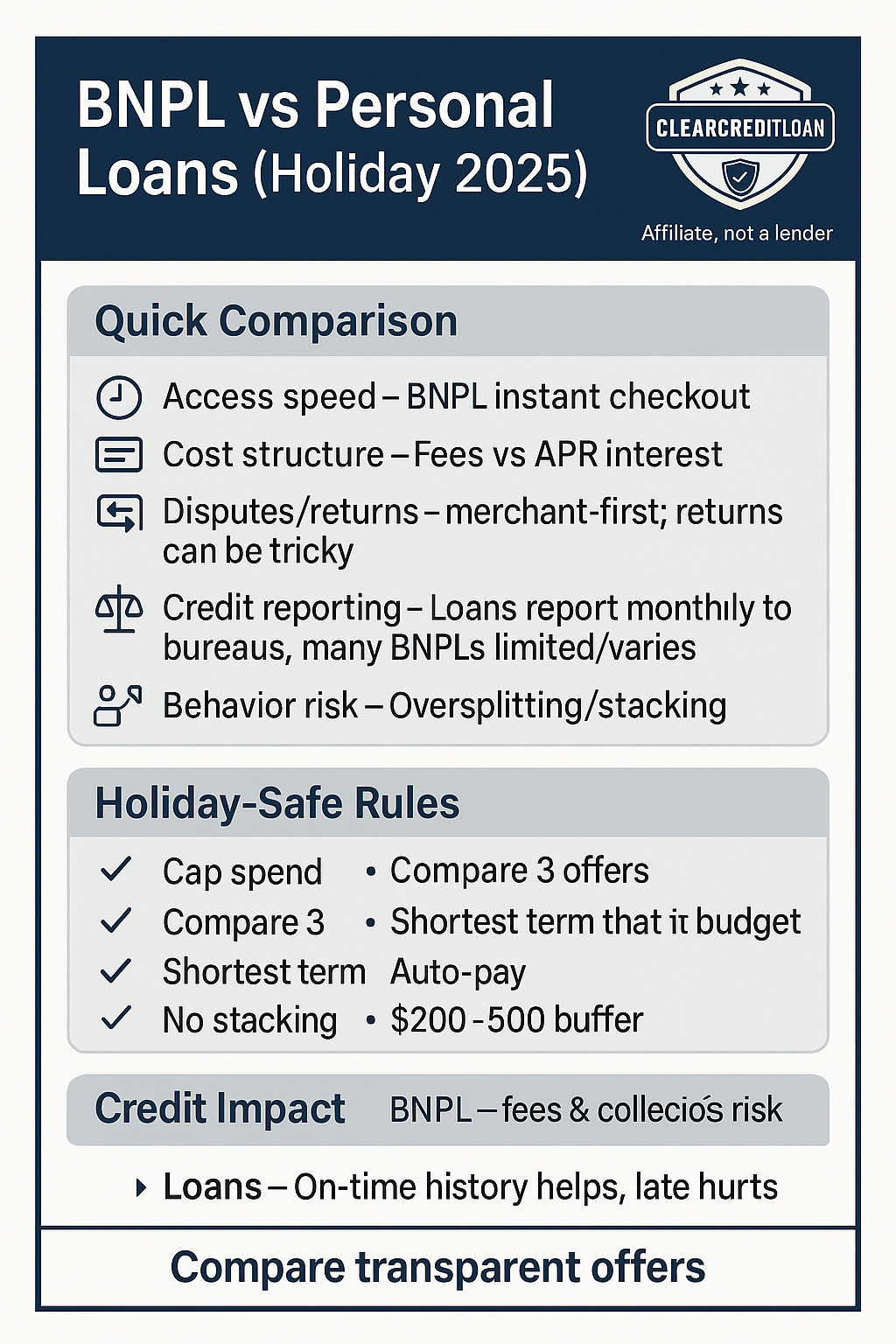

BNPL vs personal loans: quick comparison

- Speed & access. BNPL is embedded at checkout and easy to approve; personal loans require an application but can fund larger baskets.

- Cost structure. Many BNPL “pay-in-4” plans advertise no interest but often charge late fees; personal loans quote an APR (interest + certain fees) with fixed terms.

- Disputes & returns. BNPL returns can be messy; you may need to keep paying while a dispute resolves. Loans are separate from the store—returns don’t change the loan.

- Credit profile. BNPL may not always report to bureaus; missed payments can still be sent to collections. Personal loans typically report; on-time payments help, late hurts.

- Behavior risk. BNPL is frictionless at checkout and can encourage impulse buys; loans force a spending cap and a plan.

APR vs fees: the holiday math that matters

Compare APRs for loans and read BNPL fee policies carefully. A “0%” BNPL plan can become expensive with late fees; a “low-rate” loan can be costly if the APR is high or the term is too long. For plain-English BNPL guidance, use the CFPB resources (external).

When BNPL is the smarter choice (and when it isn’t)

Smarter with BNPL if:

- Cart size is small, you will repay within 6–8 weeks, and you can auto-pay from a stable account.

- The BNPL plan has clear fee rules, no junk add-ons, and an easy, timely dispute process.

Not smart with BNPL if:

- You are splitting multiple large carts across several providers (stacking risk).

- You often miss due dates or your income varies week to week.

- The return/dispute window overlaps with your payment schedule.

When a personal loan is the smarter choice (and when it isn’t)

Smarter with a personal loan if:

- You need a single, defined budget for gifts/travel and want one fixed payment with a clear payoff date.

- You can qualify for a competitive APR and a short term that fits your cash flow.

- You prefer predictable reporting to build credit with on-time payments.

Not smart with a loan if:

- The only way the monthly payment fits is by stretching the term unreasonably (total interest balloons).

- Fees (origination, prepayment penalties) erase any advantage.

- You keep spending on cards after taking the loan.

7 steps to holiday-safe borrowing (BNPL or loan)

1) Set a hard spending cap before you apply or check out.

2) Compare at least 3 options: BNPL fee policies vs loan APR/fees/term.

3) Pick shortest comfortable term—shorter usually means less total interest.

4) Automate payments for the day after payday; enable alerts.

5) Hold a $200–$500 micro-buffer so surprises don’t trigger new debt.

6) No stacking: choose one plan and stop opening more tabs or apps.

7) Track weekly: spend vs list; balance vs schedule; adjust early.

Credit score impact: BNPL vs personal loans

- BNPL: Some lenders may not furnish ongoing data; missed payments can still go to collections, harming credit.

- Personal loans: On-time installments can help; delinquencies hurt. Opening/closing credit lines and utilization changes also affect your score.

Holiday playbook: choose one path and lock it in

- If your basket is small and you’re certain you’ll clear it in 6–8 weeks, a single BNPL plan with auto-pay may be fine.

- If the list is bigger or you want one predictable plan, a short-term personal loan with a competitive APR is often safer—provided you do not re-spend elsewhere.

For budgeting tactics that make any plan stick, see How to Budget and Save Money. For loan cost intuition over time, see How Amortization Works.

Common mistakes that cause a 2026 debt hangover

- Treating BNPL as “free” and stacking multiple plans.

- Picking the lowest monthly payment by extending a loan term too long.

- Ignoring late fees or origination/transfer fees that change the real cost.

- Not automating payments; one late week erases savings.

We’re an affiliate, not a lender. Compare transparent offers by APR, fees, and term—or confirm BNPL fee policies—then lock the shortest, affordable plan. Automate it, protect essentials, and give yourself a calmer January.