Debt consolidation for multiple creditors can turn many chaotic bills into one predictable payment—if you choose the right method and price. Done poorly, it may add fees, extend your term, or hurt your credit. This guide explains the options, trade-offs, and a step-by-step plan to consolidate debt responsibly.

What debt consolidation does—and doesn’t do

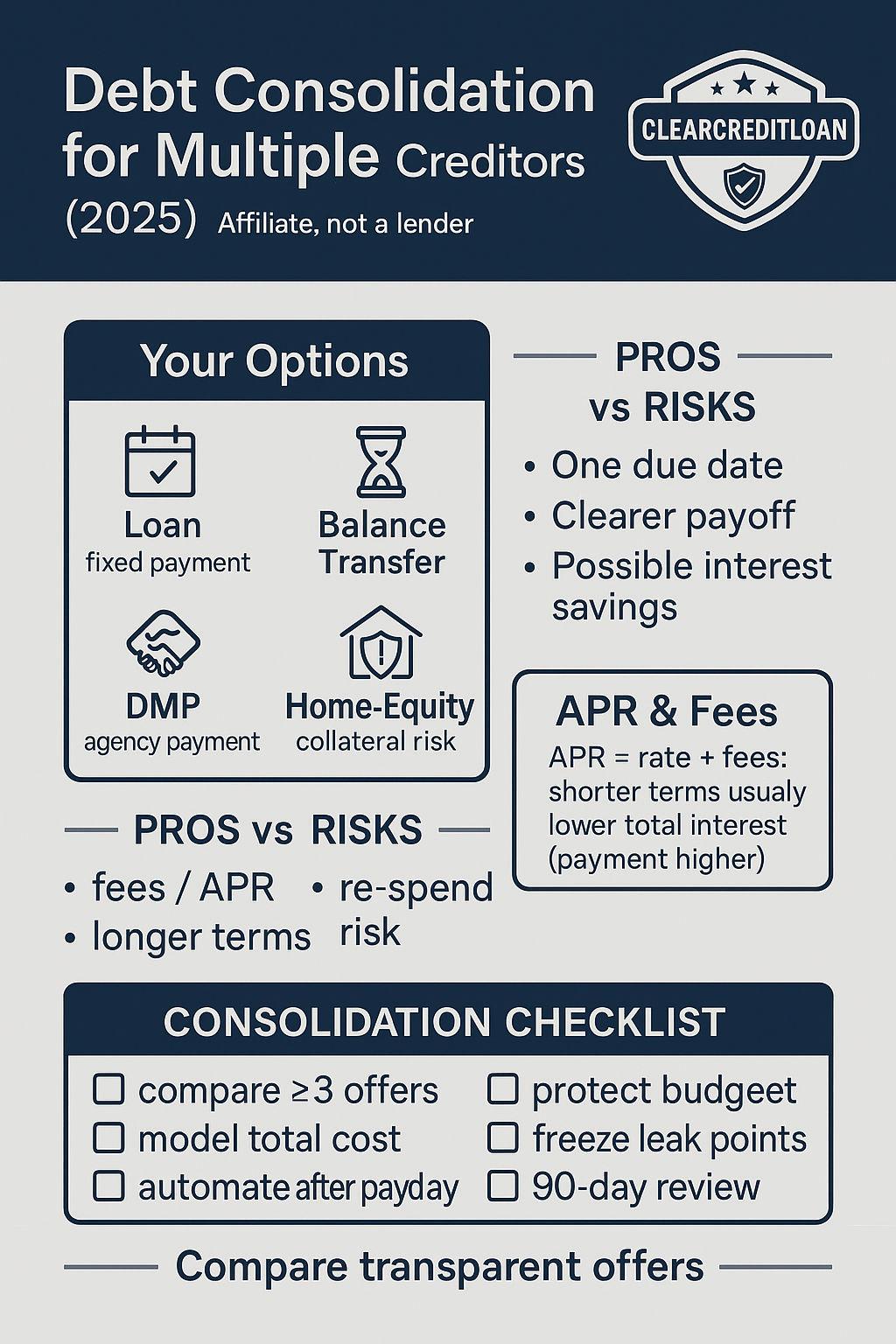

Consolidation combines several balances into a single plan or account, ideally at a lower APR or with clearer terms. It simplifies due dates and may reduce total interest if you keep spending under control. It does not erase debt, and it can cost more if fees are high or the new term is much longer.

APR vs interest rate (why it changes the real cost)

The APR includes interest plus certain fees (e.g., origination), which makes comparisons fair. A “lower rate” isn’t automatically cheaper if the APR is higher or the term is longer. For a plain-English overview, see CFPB guidance

Options to consolidate debt from multiple creditors

1) Debt consolidation loan (unsecured personal loan). One fixed payment, set term, predictable amortization. Watch APR, origination fees, and prepayment penalties. Strongest for disciplined budgets and borrowers with fair-to-good credit.

2) Balance transfer credit card. 0% intro APR periods can slash interest for a time. Transfer fees apply; the promo expires. Requires strict payoff plan before the clock runs out.

3) Debt Management Plan (DMP) through a nonprofit agency. They negotiate lower rates/fees with card issuers; you make one payment to the agency. Your credit accounts may be closed while on the plan. Good for structure and lower rates if loan approval is tough.

4) Home-equity products (HELOC/Home Equity Loan). Often lower rates, but they’re secured by your home—you risk foreclosure for missed payments. Consider only with stable income and conservative borrowing.

5) Debt consolidation for bad credit. Expect higher APRs, smaller loan amounts, or a DMP as a safer bridge. Focus on rebuilding credit factors while paying down.

6) Debt settlement programs. Not consolidation: they ask you to stop paying creditors, then negotiate. This crushes credit, adds fees, and risks lawsuits. Approach with extreme caution.

Pros and risks to weigh

Pros: one due date, clearer payoff date, potential interest savings, lower stress, fewer late fees.

Risks: higher APR/fees than you expect, longer terms that inflate total interest, temptation to re-spend after consolidation, collateral risk (for secured options), and credit score dips if accounts are closed or utilization spikes.

Will consolidation help or hurt my credit?

It can help by stabilizing payments and reducing interest—if you pay on time and avoid new balances. It can hurt if you miss payments, open/close accounts aggressively, or max a new credit line. Utilization (balances/limits) still matters.

Step-by-step plan to consolidate multiple debts

1) Inventory all debts. Balance, APR, minimum, due date, remaining term, fees.

2) Sort by APR and by size. Identify high-APR targets and “quick wins.”

3) Pick your path: loan, balance transfer, or DMP. Choose based on approval odds, APR math, and behavior fit.

4) Compare at least 3 offers. Check APR (not just rate), fees, term, and prepayment rules.

5) Model total cost. Shorter term usually means less interest, but a higher payment—confirm it fits your cash flow.

6) Protect your budget. Automate the new payment right after payday. Add a small emergency buffer to avoid new card swipes. See How to Budget and Save Money for tactics.

7) Close leak points. Freeze or reduce limits on old cards if overspending is a risk.

8) Track credit & utilization. Keep balances falling month over month.

9) Review at 90 days. If rate or term is worse than expected, consider refinancing or moving to a DMP.

Which option fits different borrower profiles?

- Stable income, fair-good credit: consolidation loan or balance transfer with a defined payoff date.

- Irregular income or approval issues: DMP for structured relief and creditor cooperation.

- Homeowners with strong equity and stable jobs: home-equity loan only if total cost is lower and risk is acceptable.

- Severe delinquency: talk to a nonprofit credit counselor; settlement or bankruptcy may be last-resort paths.

Cost controls most people miss

- Origination fees on loans and transfer fees on cards change the APR—price them in.

- A longer term lowers the payment but can raise total interest dramatically.

- Don’t refill old cards; otherwise you’ll owe both the loan and new card balances.

- Automate minimums on any accounts not consolidated to prevent late fees and score damage.

Red flags (pause before you sign)

- The “savings” only appear because the term is far longer.

- You don’t have a line-item budget for the new payment.

- The provider pressures you to decide today or add paid extras you don’t understand.

- The plan requires you to stop paying creditors to “force a settlement.”

We’re an affiliate, not a lender. Use our comparison page to review personal loans, balance transfer windows, and DMP options by APR, fees, and term. Choose one path, automate it, and protect your progress day one.