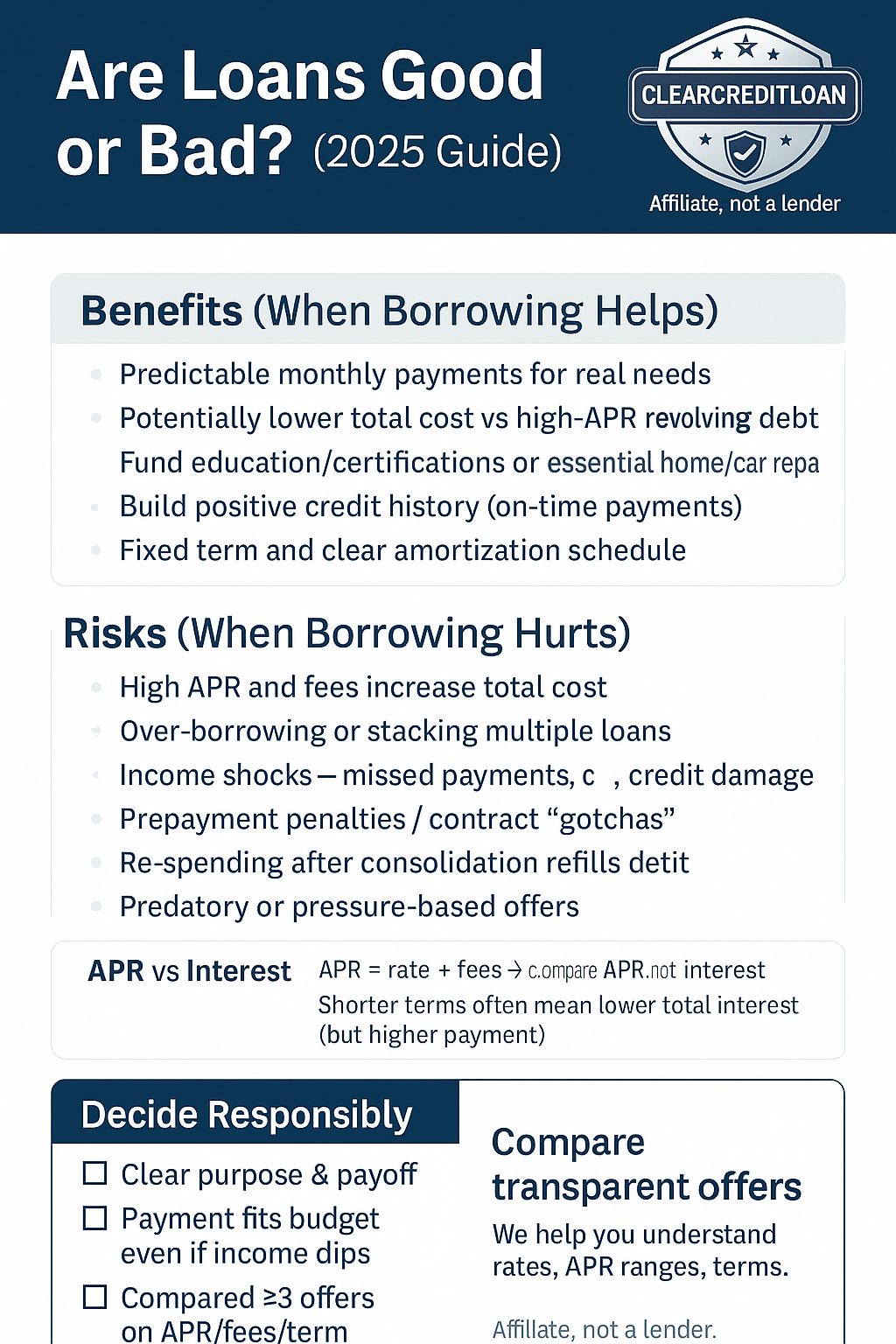

Are loans good or bad? The honest answer is: it depends on purpose, cost, and discipline. Used with a plan, credit can help you bridge timing gaps, consolidate high-interest debts, or invest in education and home improvements. Used carelessly, it can snowball into fees, stress, and long-term damage to your credit profile. This guide breaks down the real benefits and risks—then gives you a simple checklist to decide responsibly.

Benefits of loans: when borrowing is good

1) Cash-flow smoothing for real needs. A well-structured personal loan can cover necessary expenses (medical, car repair, moving) while you pay it down predictably each month.

2) Lower total cost vs revolving debt. If you replace high-interest balances with a fixed-rate installment loan, you may reduce interest paid over time—especially if you avoid new revolving debt afterward.

3) Goal-aligned investments. Funding education, certifications, or targeted home improvements can increase earning power or property value when the numbers pencil out.

4) Building a positive credit history. Making on-time payments adds consistent positive data to your credit reports, potentially improving your score over time.

5) Predictability and structure. Installment loans have a set term, fixed payment, and a clear amortization schedule, making budgeting simpler than variable balances.

APR, interest, and total cost (why it matters)

Two borrowers can take the same amount and pay very different totals because of their APR and fees. Understanding the difference between nominal interest vs APR—and how repayment speed changes the cost—is crucial. If you want an intuitive explainer, see How Amortization Works (internal resource). Also review official guidance from the CFPB on comparing loans (external resource).

Risks of loans: when borrowing is bad

1) High APR and fees. Short-term “quick cash” offers and some unsecured loans can carry steep costs. Small monthly differences compound into significant totals.

2) Over-borrowing. Taking more than you need (or layering multiple loans) turns today’s convenience into tomorrow’s budget strain.

3) Payment shock and life changes. Job shifts, emergencies, or income volatility can turn a comfortable payment into an unpayable one—leading to late fees and credit damage.

4) Prepayment restrictions. Some contracts include prepayment penalties or odd fee structures; always read the fine print before signing.

5) Temptation to spend. Consolidating debt frees up available credit—don’t refill it. Otherwise, you end up paying for the same lifestyle twice.

6) Credit profile risk. Late or missed payments can pull your score down quickly and remain on your reports for years.

7) Predatory lending and loan stacking. Be cautious of aggressive ads, unrealistic promises, or pressure to take multiple loans at once.

Are loans good or bad for your credit?

Used responsibly (on-time payments, low overall debt-to-income, no new unnecessary debt), a personal loan can diversify your credit mix and potentially help your score. Used poorly (late payments, delinquencies, rapidly stacking debt), it can harm your credit and increase future borrowing costs.

11 Essential truths to weigh benefits vs risks

1) Purpose beats impulse: borrow for defined, high-priority needs with measurable payoff.

2) APR is the “all-in” price tag: compare APR, not just the headline rate.

3) Total cost > monthly payment: a low payment with a long term may cost more overall.

4) Fees count: origination, late, prepayment—price them in.

5) Budget first, borrow second: confirm the payment fits your monthly cash flow.

6) Shorter terms usually mean lower total interest (but higher payment).

7) Fixed beats fuzzy: prefer fixed-rate, transparent terms over vague or variable.

8) Avoid stacking: one affordable plan is safer than multiple overlapping loans.

9) Consolidation works only if you stop the bleeding (no new high-interest balances).

10) Read the fine print: penalties, variable triggers, and “gotchas” hide there.

11) Protect your credit health: automate payments and track utilization across accounts.

A simple decision checklist (responsible borrowing)

- Do I have a specific, high-priority use with a clear financial or practical payoff?

- Have I compared at least three offers on APR, total cost, term, and fees?

- Can I afford the payment even if my income dips or expenses rise?

- Will this loan reduce my overall interest burden (e.g., through consolidation)?

- Is there a realistic payoff plan (timeline, budget, automation)?

- Have I ruled out cheaper alternatives (payment plan, side income, negotiating bills)?

- Would this borrowing help my long-term credit profile rather than hurt it?

Smart ways to lower borrowing costs

- Improve credit factors before applying (reduce balances, fix errors, avoid new hard pulls).

- Choose the shortest term you can comfortably afford to cut total interest.

- Consider consolidation only with strict spending controls thereafter.

- Refinance if rates fall and there are no heavy prepayment penalties.

- Use automation to avoid late fees and protect your credit.

When a personal loan makes sense (examples)

- Replacing 25%+ APR revolving debt with a transparent, fixed-rate installment—combined with a written budget.

- Funding a certification that reliably raises income, with payback modeled in months, not guesswork.

- Essential car or home repairs that protect income or safety.

When to pause or say no

- The payment only works if “everything goes right.”

- You cannot clearly explain the APR, term, total cost, and fees.

- You are borrowing to make another minimum payment—or to cover nonessential spending.

- The lender pressures you to sign today or add extra products you don’t understand.

We’re an affiliate, not a lender. Our role is to help you compare reputable providers and understand trade-offs so you can choose responsibly. When you’re ready, use our comparison page to review rates, APR ranges, terms, and eligibility in one place—then apply with confidence knowing exactly what you’ll pay and why.