Finding the best loan options can feel like navigating a maze in the dark. You know you need funds, but every “easy” offer seems to have hidden risks, and traditional banks often make the process difficult. This difficulty is a major pain point for borrowers.

Whether you’re a student needing tuition, an employee with bad credit, or someone needing fast cash for an emergency, your situation is unique. As a financial education platform, ClearCreditLoan is here to turn on the lights. We are not a lender. We are a trusted guide, here to help you understand the different types of loans available so you can compare and find the best solution for you.

The “Pain Point”: Why Is Borrowing Money So Difficult?

If you’re finding it hard to get a loan, you’re not alone. Lenders are businesses, and their main goal is to manage risk. The “difficulty” usually comes from one of these three areas:

- Your Credit Score: This is the biggest factor. A low credit score (or no credit history, like many students) signals “high risk” to lenders, leading to instant denials or sky-high interest rates. Understanding your credit score (FICO score) is the first step.

- Your Income / DTI: Lenders need to see stable income and a low Debt-to-Income (DTI) ratio. If your existing debts are too high, they won’t lend you more.

- Stricter Bank Policies: As we’ve discussed, traditional banks are becoming stricter with lending in the current economy.

Finding the Best Loan Options for Your Situation

The “best” loan is the one that matches your specific need with the lowest possible APR. Let’s break down the suggestions.

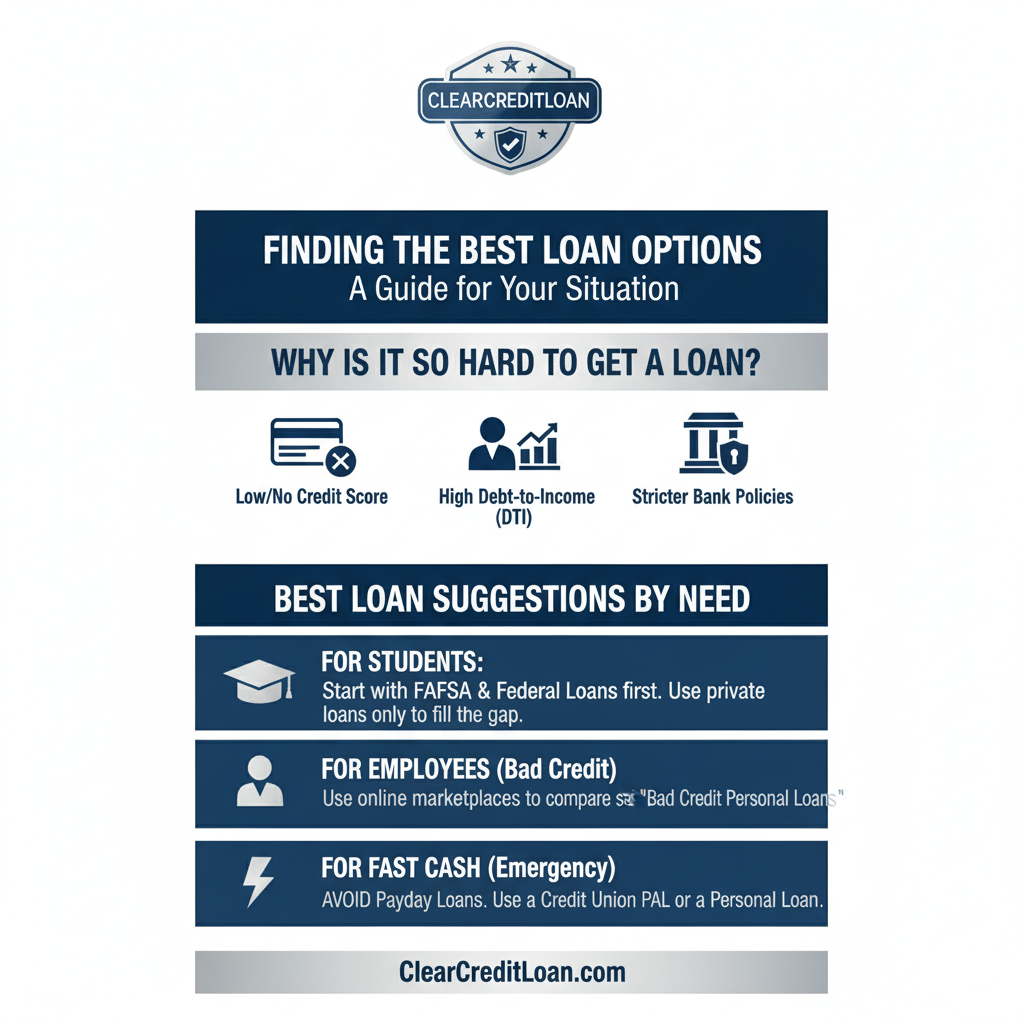

1. Best Loan Options for Students

For students, the “difficulty” is often a lack of income or credit history. Your strategy must start with federal aid.

- Option 1 (Best): Federal Student Loans (FAFSA): This should always be your first choice. They offer fixed rates, borrower protections, and forgiveness programs.

- Option 2 (For Gaps): Private Student Loans: Used to cover the remaining costs after federal aid is maxed out. You will almost certainly need a cosigner (like a parent) to get approved.

- Action: Read our complete guide to student loans to understand the FAFSA and the difference between subsidized/unsubsidized loans.

2. Best Loan Options for Employees/Workers

For employees, the “difficulty” is often a bad credit history from past financial mistakes. Traditional banks will say no.

- Solution: Online “Bad Credit” Personal Loans: This is your best solution. These are installment loans from lenders who specialize in bad credit. The APRs are higher than a bank’s, but infinitely safer and cheaper than a payday loan.

- How to Find Them: Use a loan marketplace (like our partners). These platforms let you compare offers from multiple lenders with a single “soft pull,” which doesn’t hurt your credit score.

- Action: See our guide to bad credit loan options to learn how to compare them safely.

3. “Fast Loan” Options

This is the most dangerous category. The “difficulty” is the need for speed, which makes you a target for predatory loans

- The TRAP (Avoid!): Traditional Payday Loans: These are not a real solution. As the CFPB (Consumer Financial Protection Bureau) warns, their 400%+ APRs and 2-week repayment terms are designed to trap you in a cycle of debt.

- The “Safer” Alternative: Look for “Payday Alternative Loans” (PALs) from a credit union, or use a “cash advance” app.

- The Best Solution: If you must borrow, use one of the safer payday alternatives or a bad credit personal loan (from Option 2), which gives you months (not days) to repay.

Your Best Loan Options Strategy: 3 Final Tips

No matter your situation, follow these 3 steps:

- Know Your Credit: Check your credit score first. It’s free.

- Know Your “Why”: Are you “investing” (education) or “consuming” (vacation)? Be honest.

- Compare, Compare, Compare: Never take the first offer. Comparing APRs is the only way to save money.

Navigating the world of loans is difficult, but you have more options than you think. The key is to avoid predatory traps and compare legitimate lenders.

ClearCreditLoan can help. Use our free, secure tool to compare pre-vetted loan partners for students, bad credit, and emergency needs. See your options without impacting your credit score.