Ever looked at your loan statement after a year of payments and felt frustrated? You’ve paid thousands, yet your balance barely budged. This painful feeling is universal, and the reason is a concept called amortization. Understanding how amortization works is the key to truly understanding your debt.

“Amortization” is a fancy financial term for how your fixed loan payment is split between principal (the money you actually borrowed) and interest (the fee you pay for borrowing it). It’s not a 50/50 split. As a financial education platform, ClearCreditLoan is here to demystify this process. This guide will use a simple example to show you exactly where your money goes and how your money is really working.

What Is Amortization (And Why Does It Matter)?

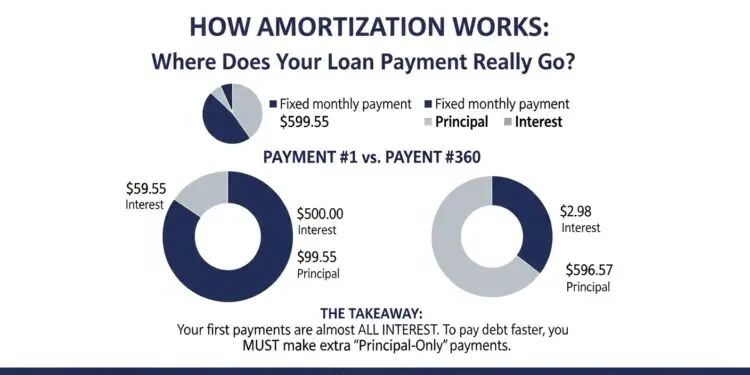

Amortization is the process of spreading out a loan into a series of fixed, equal payments over a set period of time. While your payment amount stays the same every month (e.g., $599.55), the ratio of what’s inside that payment changes dramatically.

Understanding how amortization works is critical because it shows you the true cost of your loan over time and reveals why paying extra can save you thousands.

A Simple Example: How Amortization Works

Let’s use a clear, common example:

- Loan Amount (Principal): $100,000

- APR (Interest Rate): 6% per year (which is 0.5% per month)

- Loan Term: 30 years (360 payments)

- Your Fixed Monthly Payment: $599.55

Here is how your first payment and your last payment are broken down:

Payment #1 (The First Month)

- Interest Calculation: Your bank first calculates the interest owed for that month.

- 0.5% (monthly rate) x $100,000 (current balance) = $500.00 (Interest)

- Principal Calculation: The rest of your payment goes to the principal.

- $599.55 (Your Payment) – $500.00 (Interest) = $99.55 (Principal)

Result: In your first month, 83% of your payment ($500) went to the bank as pure profit (interest). Only $99.55 went to reducing your actual $100,000 debt. Your new balance is $99,900.45.

Payment #360 (The Last Month)

- Interest Calculation: Now, 30 years later, your remaining balance is only about $596.57.

- 0.5% (monthly rate) x $596.57 (current balance) = $2.98 (Interest)

- Principal Calculation: The rest of your payment pays off the loan.

- $599.55 (Your Payment) – $2.98 (Interest) = $596.57 (Principal)

Result: In your last month, almost 100% of your payment went to the principal, and your loan balance drops to $0.

The “Aha!” Moment: Why Your Loan Balance Barely Moves at First

This example reveals the “pain point” of amortization: Your early payments are heavily front-loaded with interest.

This is why you can pay $7,200 ($599.55 x 12) in the first year, but your $100,000 loan balance only drops by about $1,200. This is a normal (though frustrating) part of how these loans are structured. The Consumer Financial Protection Bureau (CFPB) has many resources explaining this process.

How This Applies to Personal Loans & Student Loans

This same principle applies to all amortized loans, just on different timelines.

- Student Loans: A 10-year federal student loan works the same way. Your first few years of payments are heavily skewed toward interest. This is crucial to know when deciding to pay them off. (See our guide to student loans).

- Personal Loans: A 5-year personal loan is also amortized. Knowing this shows the incredible value of finding a loan with a lower APR. A lower APR means more of your very first payment goes to principal, helping you build equity faster. This is critical for strategies like our 5-step guide to debt consolidation.

How You Can “Beat” Amortization

Now you know the secret, how do you fight back?

- Make Extra Principal Payments: Pay just $100 extra per month (and specify it’s “for principal only”). This extra $100 skips the interest calculation and attacks the balance directly. Using an an extra mortgage payment calculator can show you that this simple trick could shave years and tens of thousands of dollars off a 30-year loan.

- Get a Shorter Loan Term: A 15-year loan (instead of 30) will have higher payments, but the amortization schedule is far more aggressive, building your principal faster.

Now you know how amortization works, you understand that the APR (interest rate) is the most powerful factor in your loan. A lower APR means more of your money goes to you (principal) instead of the bank (interest) right from Day 1.

The smartest move you can make is to secure the lowest APR possible.

ClearCreditLoan can help. Use our free tool to compare pre-vetted loan partners and see if you can get a more favorable rate. See your options without impacting your credit score.