Wondering how to pay for college with no money? The stress of a tuition bill you can’t cover or the pain of wanting to “invest in knowledge” (like a certification) but having no funds is one of the biggest hurdles students face. It can feel like your future is on hold.

This “this pain” is real, but it is not a dead end. Millions of students successfully fund their education every year, many starting with little to no family support. The secret is knowing the process.

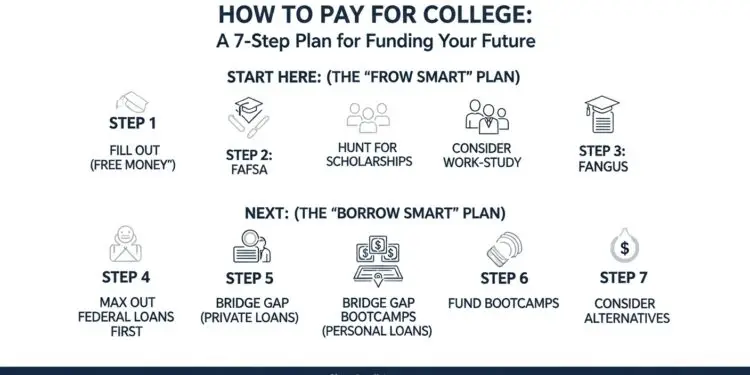

As a financial education platform, ClearCreditLoan is here to provide that process. We are not a lender. We are here to give you a clear, unbiased 7-step strategy. This is your guide on how to pay for college with no money by building a smart funding strategy to fund your future.

The Pain: Why Having No Money for College Is So Stressful

The “pain” of having no money for college isn’t just about the tuition bill. It’s a cycle of stress:

- FOMO (Fear of Missing Out): Watching peers advance while you feel stuck.

- Knowledge Gaps: Wanting to “invest in knowledge” (like an online bootcamp or certification) but lacking the cash, which you know could lead to a better job.

- Constant Anxiety: Worrying about how you’ll pay for the next semester, books, or even just essential living expenses.

This guide is your 7-step plan to break that cycle.

A 7-Step Plan for How to Pay for College with No Money

Follow these steps in order. Do not skip Step 1.

Step 1: Fill Out the FAFSA (The “Must-Do”)

This is the single most important step. The FAFSA (Free Application for Federal Student Aid) is the key that unlocks all federal financial aid.

- What it is: A form that assesses your financial need.

- Why it matters: It determines your eligibility for grants (free money), work-study (earned money), and federal student loans (the safest loans).

- Action: Go to the official StudentAid.gov website and fill it out. It’s free. Do this as soon as it opens each year.

Step 2: Actively Hunt for Scholarships and Grants

This is “free money” you never have to pay back.

- Grants: The FAFSA will automatically qualify you for Pell Grants if your need is high enough.

- Scholarships: This requires work. Apply for everything: local community scholarships, university-specific scholarships, and use reputable scholarship search engines to find niche awards. Treat it like a part-time job.

Step 3: Consider Federal Work-Study

If offered (based on your FAFSA), the Work-Study program provides part-time jobs (often on campus) where the earnings are meant to help pay for school expenses. It’s a great way to earn income without hurting your aid eligibility.

Step 4: Max Out Federal Student Loans First

After grants, scholarships, and work-study, you will likely still have a “gap.” Your first borrowing option should always be Federal Student Loans (Direct Subsidized and Unsubsidized).

- Why: They have fixed interest rates, borrower protections, and forgiveness programs (like IDR) that private loans do not offer.

- Action: Read our complete guide to Federal vs. Private loans to understand the critical differences.

Step 5: Bridge the Final Gap with Private Student Loans

If you’ve maxed out your federal options and still have a tuition gap, a private student loan (from a bank, credit union, or online lender) is the next step. You will almost certainly need a cosigner if you have no income or credit.

Step 6: Funding “Upskilling” (Bootcamps & Certs)

What about “investing in knowledge” that isn’t a traditional college? Coding bootcamps, IT certifications, and professional online courses are often not eligible for federal aid.

- Solution: This is where a personal loan becomes a tool. If you are learning how to pay for college with no money for these specific programs, you must treat it as an investment.

- Action: Read our guide on using a personal loan for an online course to see if the ROI makes sense.

Step 7: Consider Cost-Saving Alternatives

If the numbers still don’t add up, be strategic.

- Community College: Start at a (much cheaper) community college for 2 years to complete your core classes, then transfer to a 4-year university.

- Go Part-Time: Work full-time and take classes part-time, paying as you go.

Figuring out how to pay for college with no money is a puzzle. By combining FAFSA, scholarships, and smart borrowing, you can build a strategy. If you find you have a funding gap that federal aid can’t cover, the next step is to compare safe, private options.

ClearCreditLoan can help. Compare pre-vetted loan partners that specialize in student and personal loans to help you bridge the gap. See your options for free.