Searching for bad credit loans can feel overwhelming and even a bit scary. When traditional banks turn you down, where do you go? The internet is full of offers, but not all are created equal. Some can trap you in a cycle of debt.

Having bad credit doesn’t mean you’re out of options, but it does mean you need to be extra cautious. As a financial education platform, ClearCreditLoan is here to provide unbiased information. We don’t lend money, but we help you understand the landscape of bad credit loans, the major risks involved (like sky-high APRs), and how to compare your options responsibly.

Understanding Bad Credit Loans: What Are They?

Bad credit loans are personal loans specifically designed for individuals with a poor credit history (typically a FICO score below 630). Because these borrowers are seen as higher risk, these loans almost always come with:

- Higher Interest Rates (APRs): Significantly higher than loans for good credit.

- Lower Loan Amounts: Lenders may offer smaller sums.

- Potentially More Fees: Such as origination fees.

It’s crucial to understand that bad credit loans are a tool for emergencies or necessary expenses, not for frivolous spending.

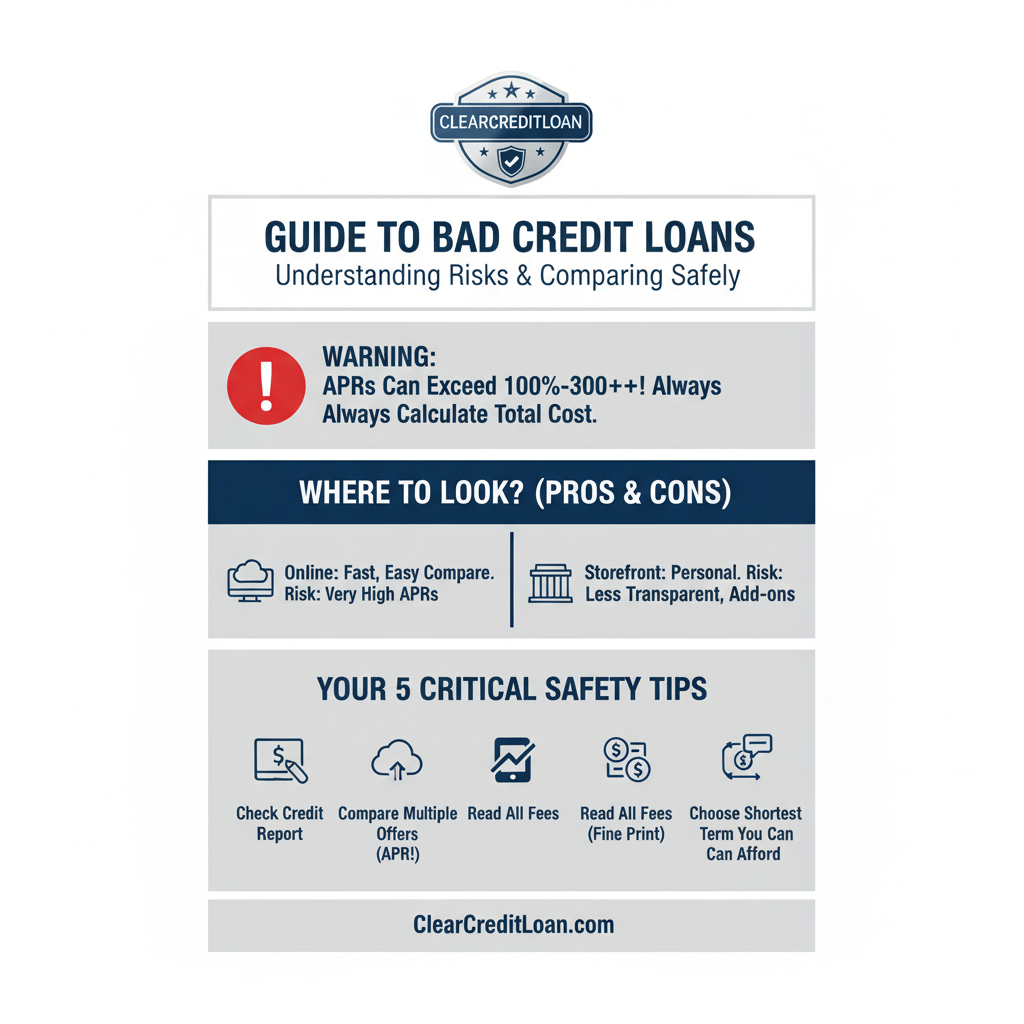

Online vs. Storefront: Where to Find Bad Credit Loans?

You generally have two main places to look:

1. Online Lenders & Marketplaces

These operate entirely online, offering convenience and speed.

- Examples: Platforms like

Honestloans,Hotloanstoday,Fastmoneysource,Cashfinance, andCashforloansnowoften function as marketplaces. You fill out one form, and they connect you with multiple lenders willing to consider your application. - Pros: Fast application, quick funding (sometimes next business day), easy comparison of multiple offers.

- Cons: APRs can be very high (sometimes triple digits), less personal interaction. You must verify the legitimacy of the platform and the end lender. These are distinct from payday loan alternatives which sometimes have regulatory caps.

2. Storefront Lenders (Brick-and-Mortar)

These are physical locations you can visit (e.g., OneMain Financial, World Finance).

- Pros: Face-to-face interaction, potentially more flexible underwriting (looking beyond just the score), sometimes offer secured options (using a car title) which might lower the rate.

- Cons: Can be less transparent about APRs upfront, may push unnecessary add-ons (like credit insurance), process might be slower, still often have high rates.

The Dangers: High APRs, Fees, and Cycles

This is the most critical section. Bad credit loans often come with APRs ranging from 36% (the high end for “fair” credit personal loans) up to over 100% or even 300%+, especially from online lenders or those resembling payday lenders (like Advance America).

High APRs mean you pay back significantly more than you borrowed. As the Consumer Financial Protection Bureau (CFPB) warns about high-cost loans, getting trapped in a cycle of re-borrowing (rollover) or refinancing just to keep up with payments is a major risk. Always calculate the total cost of the loan before signing.

5 Critical Tips for Choosing a Bad Credit Loan Lender

If you determine you need a bad credit loan, follow these steps to protect yourself:

1. Check Your Credit Report First

Know where you stand. You might qualify for better options than you think. You can check your credit report for free annually from each bureau.

2. Compare Multiple Offers (Crucial!)

This is non-negotiable. Never take the first offer you receive. Use loan marketplaces or apply to 2-3 different lenders (ensure they use a “soft credit pull” for pre-qualification so it doesn’t hurt your score). Comparing APRs is the only way to find the least expensive option.

3. Read the Fine Print (Fees!)

Look closely for:

- Origination Fee: A percentage charged upfront just for getting the loan.

- Late Fees: How much are they, and when do they apply?

- Prepayment Penalties: Can you pay the loan off early without penalty?

4. Understand the Repayment Term

A shorter term means higher monthly payments but less interest paid overall. A longer term lowers payments but costs much more in the long run. Choose the shortest term you can realistically afford.

5. Consider Alternatives First

Before signing for a high-APR bad credit loan, ask yourself:

- Can I borrow from family/friends?

- Can I negotiate a payment plan for the bill I need to pay?

- Is this expense truly necessary right now?

- Could using personal loans for upskilling lead to higher income and avoid this situation in the future?

Navigating bad credit loans requires caution. Don’t rush into a decision. The smartest move is always to compare multiple, legitimate lenders.

ClearCreditLoan provides access to compare pre-vetted loan partners specializing in options for various credit situations. See your potential offers safely and find a path forward.