Finding safe loans for low income earners or students can feel incredibly stressful. It might seem like your options are limited, and unfortunately, many “easy cash” lenders are waiting to take advantage of that stress.

The choices you make now can either build a bridge to financial stability or dig a hole of high-interest debt that’s hard to escape.

As a financial education platform, ClearCreditLoan is here to guide you. We are not a lender. Our mission is to provide clear, unbiased information to help you find the safest borrowing options and build smart saving habits.

A Critical Warning: The Payday Loan Trap

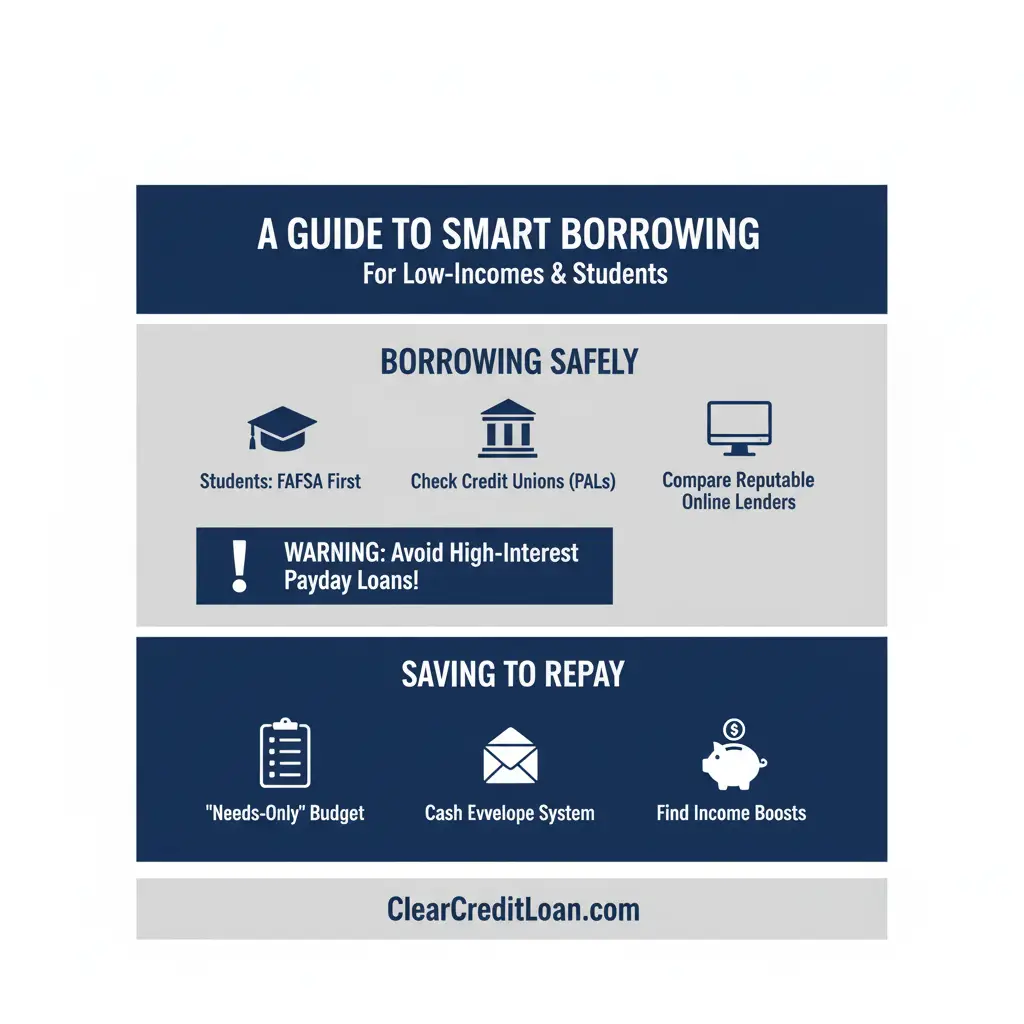

Before we explore your options, we must issue a warning. Avoid Payday Loans.

These are short-term, extremely high-interest loans designed to trap borrowers. As noted by the Consumer Financial Protection Bureau (CFPB), their interest rates (APRs) can often be 300%-400% or higher. They are a short-term “fix” that creates a long-term debt cycle. Our platform is dedicated to helping you find alternatives to these loans for low income individuals.

Part 1: Safer Loans for Low Income & Students

For Students: Federal Aid is ALWAYS First

If you are a student needing money for education, your first and only starting point should be the FAFSA (Free Application for Federal Student Aid). This gives you access to grants and safe federal loans.

For Low-Income Earners (and Students needing non-tuition funds):

- Credit Unions: If you are a member of a credit union, they often offer “Payday Alternative Loans” (PALs) or small personal loans with much lower interest rates and fairer terms.

- Secured Credit Cards: If you need to build credit, a secured card requires a small cash deposit (e.g., $200) that becomes your credit limit. It’s a safe way to build a credit history.

- Reputable Online Personal Loans: (This is our specialty) Many reputable online lenders offer personal loans for low income earners with a variety of credit profiles. Their rates are significantly cheaper and safer than payday loans.

- Family or Friends: If possible, this can be an option. Always treat it as a formal loan to protect your relationship.

Part 2: How to Save Money to Pay Off Your Loan

Borrowing is only half the battle. Repaying it on a tight budget requires a plan.

Build a “Needs-Only” Budget

Take a piece of paper and list only your absolute necessities:

- Rent/Housing

- Utilities (Electric, Water)

- Food (Groceries only)

- Transportation (to work/school)

- Your Loan Repayment

Use the Cash Envelope System

For “Want” categories, pull out a fixed amount of cash at the beginning of the month. Put it in an envelope. When the envelope is empty, you’re done spending. It makes spending “real.”

Find “Income Boosts”

Instead of just cutting, look for small ways to add income (gig work, selling items online). Put 100% of this “extra” money directly toward your loan principal.

Even with a low income, you have better options than predatory lenders. The key is to compare responsible partners who work with a variety of credit profiles.

Don’t settle for the first offer. Compare responsible personal loan partners to find a rate and term that works for you. It’s free to check and won’t impact your credit score.